What is a ‘Commercial Bank’

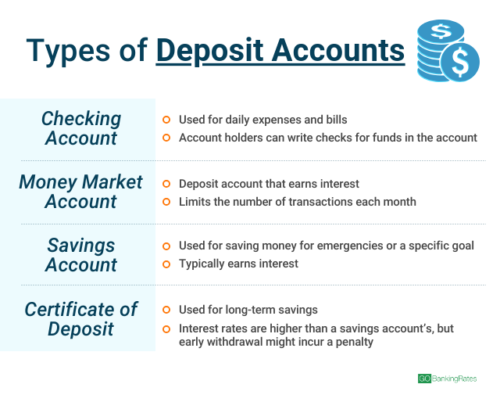

A Commercial bank is a financial institution that accepts deposits, offers checking account services, makes business, personal and mortgage loans, and offers basic financial products like certificates of deposit (CDs) and savings accounts to individuals and small businesses. A commercial bank is where most people do their banking, as opposed to an investment bank.

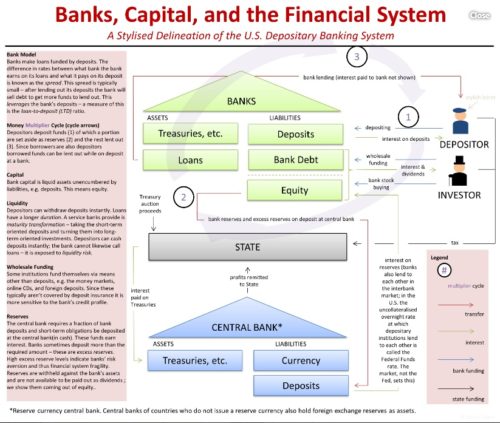

Customer deposits, such as checking accounts, savings accounts, money market accounts, and CDs, provide banks with the capital to make loans. Customers who deposit money into these accounts effectively lend money to the bank and are paid interest. However, the interest rate paid by the bank on money they borrow is less than the rate charged on money they lend.

Commercial banks make money by providing loans and earning interest income from those loans. The types of loans a commercial bank can issue vary and may include mortgages, auto loans, business loans, and personal loans. A commercial bank may specialize in just one or a few types of loans.

Commercial Banking Functions

Basic functions of commercial banks include the following:

PRIMARY FUNCTIONS:

1. Accepting Deposits

Commercial banks accept deposits from people, businesses, and other entities in the form of:

Commercial banks accept deposits from people, businesses, and other entities in the form of:

- Savings deposits – The commercial bank accepts small deposits, from households or persons, in order to encourage savings in the economy.

- Time deposits – The bank accepts deposits for a fixed time and carries a higher rate of interest as compared to savings deposits.

- Current deposits – These accounts do not offer any interest. Further, most current accounts offer overdrafts up to a pre-specified limit. The bank, therefore, undertakes the obligation of paying all cheques against deposits subject to the availability of sufficient funds in the account.

2. Lending of Funds

Another important activity is lending funds to customers in the form of loans and advances, cash credit, overdraft and discounting of bills, etc. Loans are advances that a bank extends to his customers with or without security for a specified time and at an agreed rate of interest. Further, the bank credits the loan amount in the customers’ account which he withdraws as per his needs.

Another important activity is lending funds to customers in the form of loans and advances, cash credit, overdraft and discounting of bills, etc. Loans are advances that a bank extends to his customers with or without security for a specified time and at an agreed rate of interest. Further, the bank credits the loan amount in the customers’ account which he withdraws as per his needs.

Under the cash credit facility, the bank offers its customers a facility to borrow cash up to a certain limit against the security of goods. Further, an overdraft is an arrangement that a bank offers to customers wherein a temporary facility is offered to overdraw from the current account without any security.

The limit is pre-specified. Additionally, banks also discount and purchase bills. In both of these cases, a bank credits the amount of the bill in the customer’s account after deducting discounts and commissions. Subsequently, this amount is recovered from the debtors on the maturity of the instrument.

SECONDARY FUNCTIONS

The secondary functions of a commercial bank are as follows:

1. Bank as an Agent

A bank acts as an agent to its customers for various services like:

A bank acts as an agent to its customers for various services like:

- Collecting bills, draft, cheques, etc.

- Paying the insurance premium, rent, loan installments, etc.

- Working as a representative of a customer for purchasing or redeeming securities, etc. in the stock exchange.

- Acting as an executor, administrator, or trustee of the estate of a customer

- Also, preparing income tax returns, claiming tax refunds, etc.

2. General Utility Services

There are several general utility services that commercial banks offer like:

- Issuing traveler cheques

- Offering locker facilities for keeping valuables in safe custody

- Also, issuing debit cards and credit cards, etc.

Importance of commercial banks in Economy Development:

Besides performing the usual commercial banking functions, banks in developing countries play an effective role in their economic development. The majority of people in such countries are poor, unemployed and engaged in traditional agriculture.

Besides performing the usual commercial banking functions, banks in developing countries play an effective role in their economic development. The majority of people in such countries are poor, unemployed and engaged in traditional agriculture.

When there is acute shortage of capital, people lack initiative and enterprise. Infrastructure is undeveloped. Industry is depressed. Commercial banks help in overcoming these obstacles and promoting economic development. Role of a commercial bank in a developing an Economy or a country primarily on the below areas.

1. Mobilizing Saving for Capital Formation:

The commercial banks help in mobilizing savings through network of branch banking. People in both developing and developed countries are helped by banks to develop the culture of Savings. Banks induce this culture to save by introducing variety of deposit schemes to suit the needs of individual depositors. They also mobilize idle savings of the rich. By mobilizing savings, the banks channelize them into productive investments. Thus they help in the capital formation of a developing country.

2. Financing Industry:

The commercial banks finance the industrial sector in a number of ways. They provide short-term, medium-term and long-term loans to industry. In India they provide short-term loans. Income of the Latin American countries like Guatemala, they advance medium-term loans for one to three years. But in Korea, the commercial banks also advance long-term loans to industry.

The commercial banks finance the industrial sector in a number of ways. They provide short-term, medium-term and long-term loans to industry. In India they provide short-term loans. Income of the Latin American countries like Guatemala, they advance medium-term loans for one to three years. But in Korea, the commercial banks also advance long-term loans to industry.

In India, the commercial banks undertake short-term and medium-term financing of small scale industries, and also provide hire- purchase finance. Besides, they underwrite the shares and debentures of large scale industries. Thus they not only provide finance for industry but also help in developing the capital market which is undeveloped in such countries.

3. Financing Trade:

The commercial banks help in financing both internal and external trade. The banks provide loans to retailers and wholesalers to stock goods in which they deal. They also help in the movement of goods from one place to another by providing all types of facilities such as discounting and accepting bills of exchange, providing overdraft facilities, issuing drafts, etc. Moreover, they finance both exports and imports of developing countries by providing foreign exchange facilities to importers and exporters of goods.

4. Financing Agriculture:

The commercial banks help the large agricultural sector in developing countries in a number of ways. They provide loans to traders in agricultural commodities. They open a network of branches in rural areas to provide agricultural credit. They provide finance directly to agriculturists for the marketing of their produce, for the modernization and mechanization of their farms, for providing irrigation facilities, for developing land, etc.

The commercial banks help the large agricultural sector in developing countries in a number of ways. They provide loans to traders in agricultural commodities. They open a network of branches in rural areas to provide agricultural credit. They provide finance directly to agriculturists for the marketing of their produce, for the modernization and mechanization of their farms, for providing irrigation facilities, for developing land, etc.

They also provide financial assistance for animal husbandry, dairy farming, sheep breeding, poultry farming, pisciculture and horticulture. The small and marginal farmers and landless agricultural workers, artisans and petty shopkeepers in rural areas are provided financial assistance through the regional rural banking systems. These regional rural banks operate under a commercial bank. Thus the commercial banks meet the credit requirements of all types of rural people.

5. Financing Consumer Activities:

People in underdeveloped countries being poor and having low incomes do not possess sufficient financial resources to buy durable consumer goods. The commercial banks advance loans to consumers for the purchase of such items as houses, scooters, fans, refrigerators, etc. In this way, they also help in raising the standard of living of the people in developing countries by providing loans for consumptive activities.

6. Financing Employment Generating Activities:

The commercial banks finance employment generating activities in countries. They provide loans for the education of young citizens studying in engineering, medical and other vocational institutes of higher learning. They advance loans to young entrepreneurs, medical and engineering graduates, and other technically trained persons in establishing their own business. Thus the banks not only help inhuman capital formation but also in increasing entrepreneurial activities in different countries.

7. Help in Monetary Policy:

The commercial banks help the economic development of a country by faithfully following the monetary policy of the central bank. In fact, the central bank depends upon the commercial banks for the success of its policy of monetary management in keeping with requirements of a developing economy.

Thus the commercial banks contribute much to the growth of a developing economy by granting loans to agriculture, trade and industry, by helping in physical and human capital formation and by following the monetary policy of the country.

Future Trends in Commercial Banking

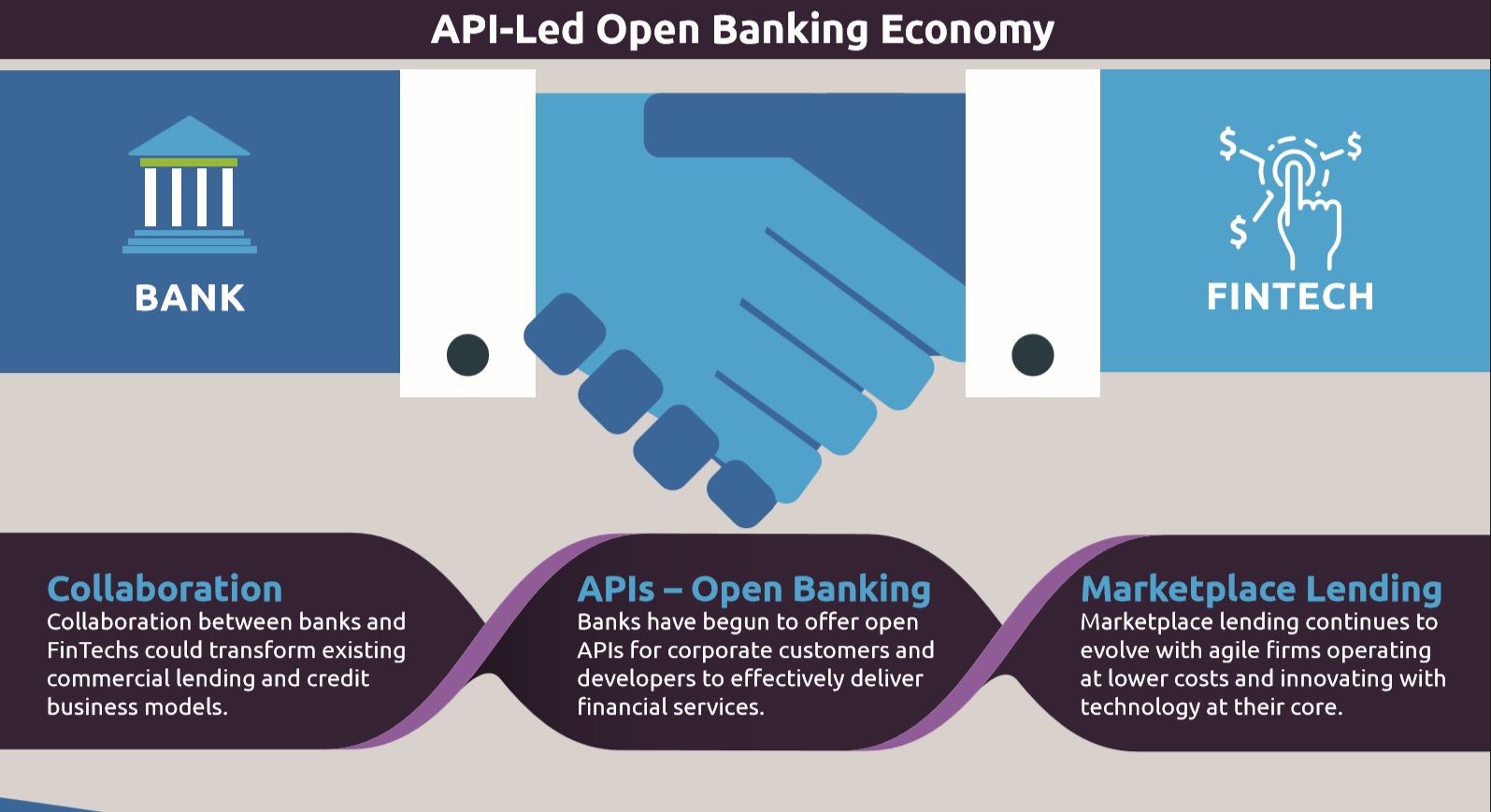

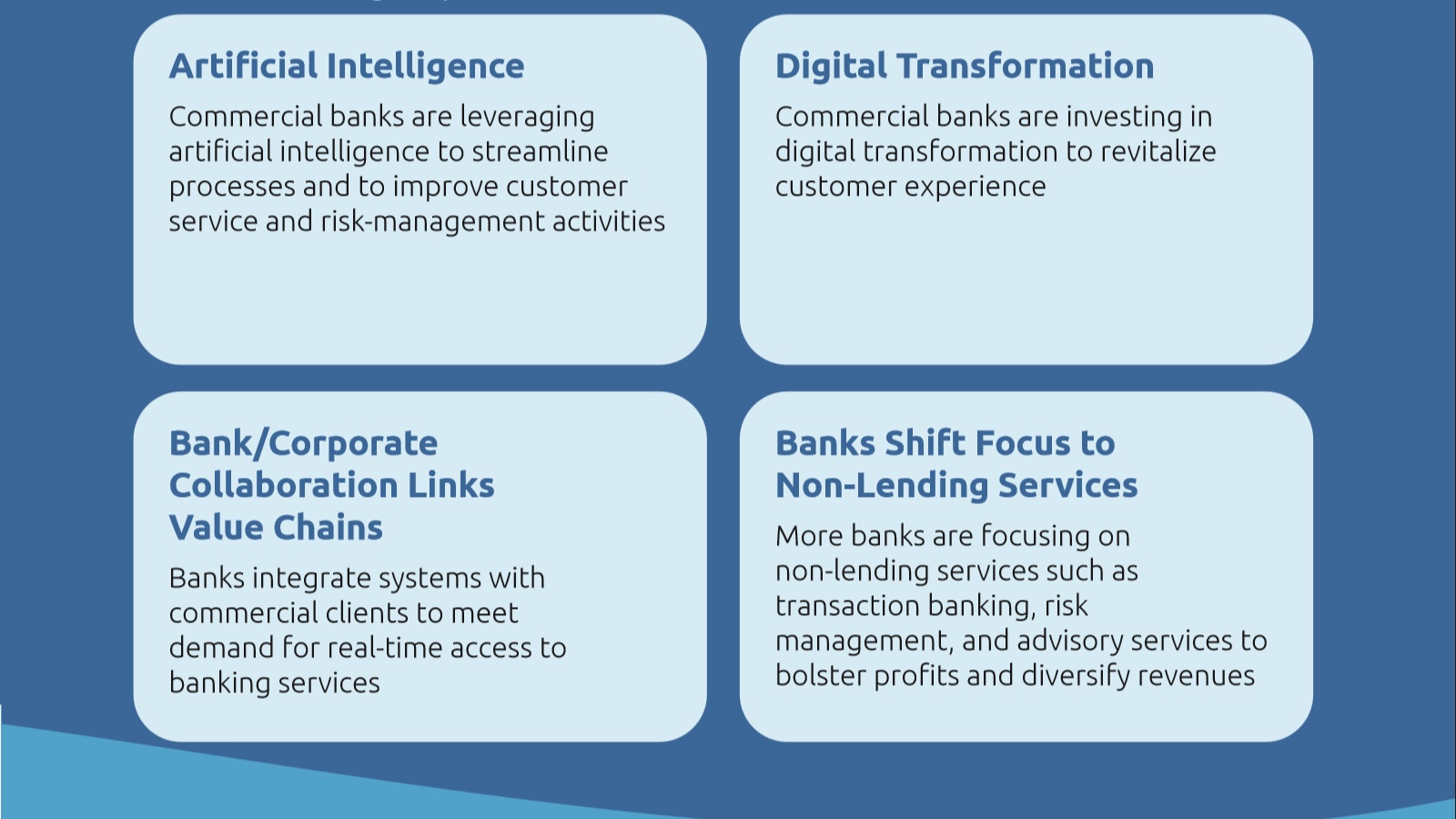

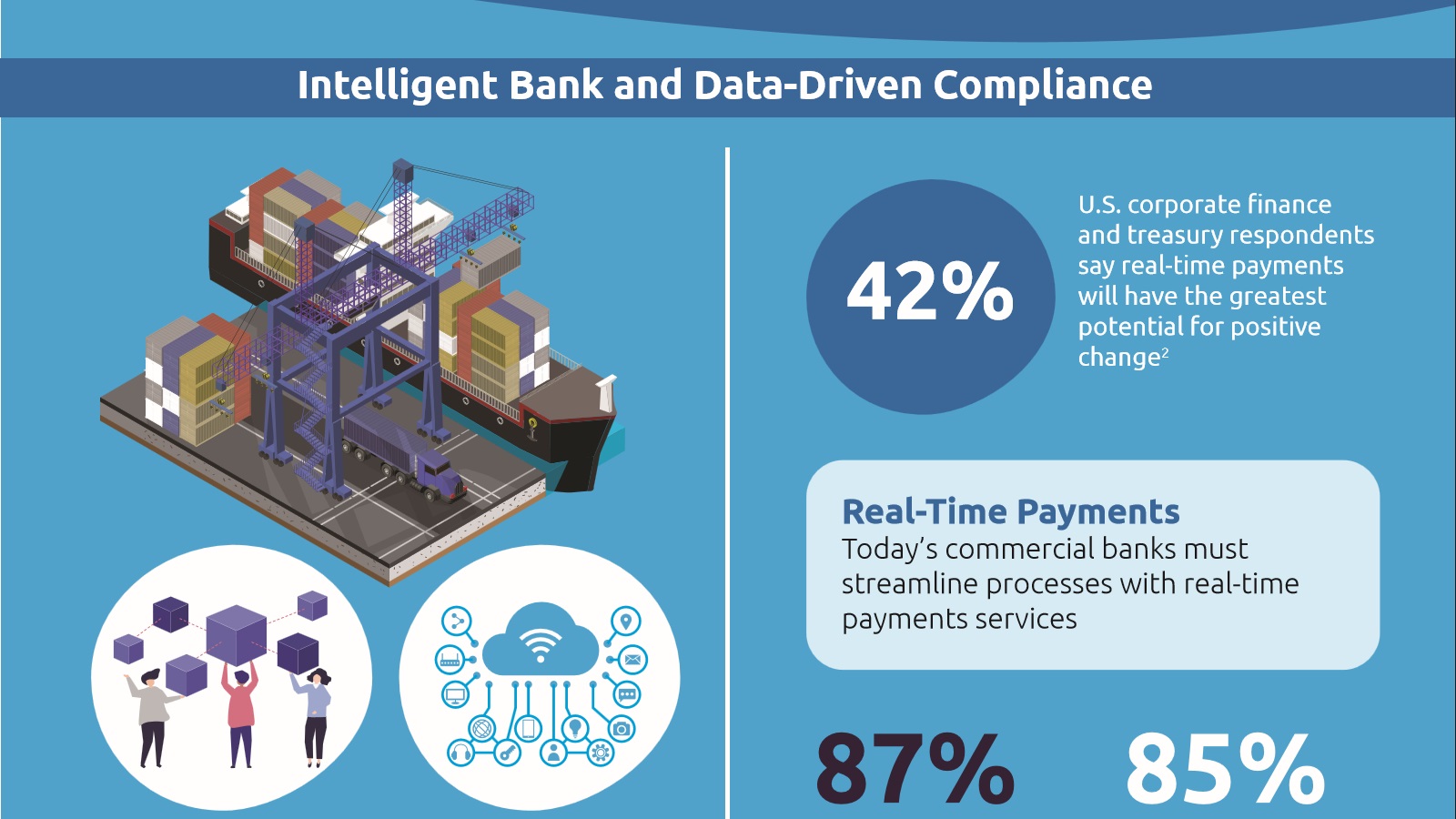

Banks are increasingly investing in emerging technologies, digitizing their processes, and collaborating with external partners to foster innovation and solve long-standing corporate client pain points. This report explores and analyzes significant commercial banking trends expected in 2019.

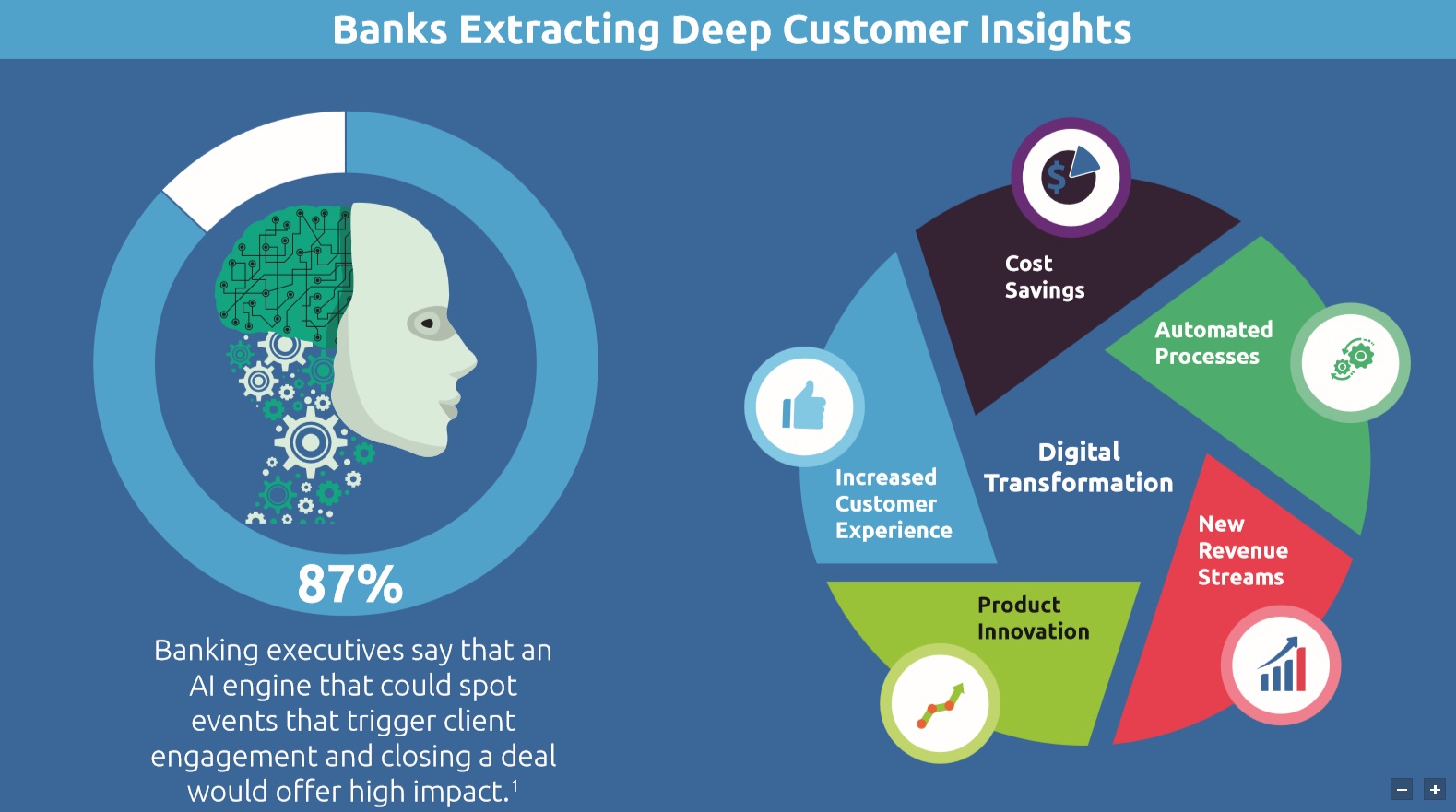

Unlike retail bank customers who rely on a single firm to handle most financial needs, corporate clients maintain relationships with several banks. The result is intense competition as commercial firms vie for wallet share. As the expectations of commercial banking customers grow, technology proliferates, and agile newcomers (FinTechs and other challenger banks) threaten to grab the most profitable aspects of commercial banking, it is a critical time for banks to invest in digital transformation and to fundamentally improve the way they serve corporate clients. The ability to retain and grow business and increase profitability is on the line.

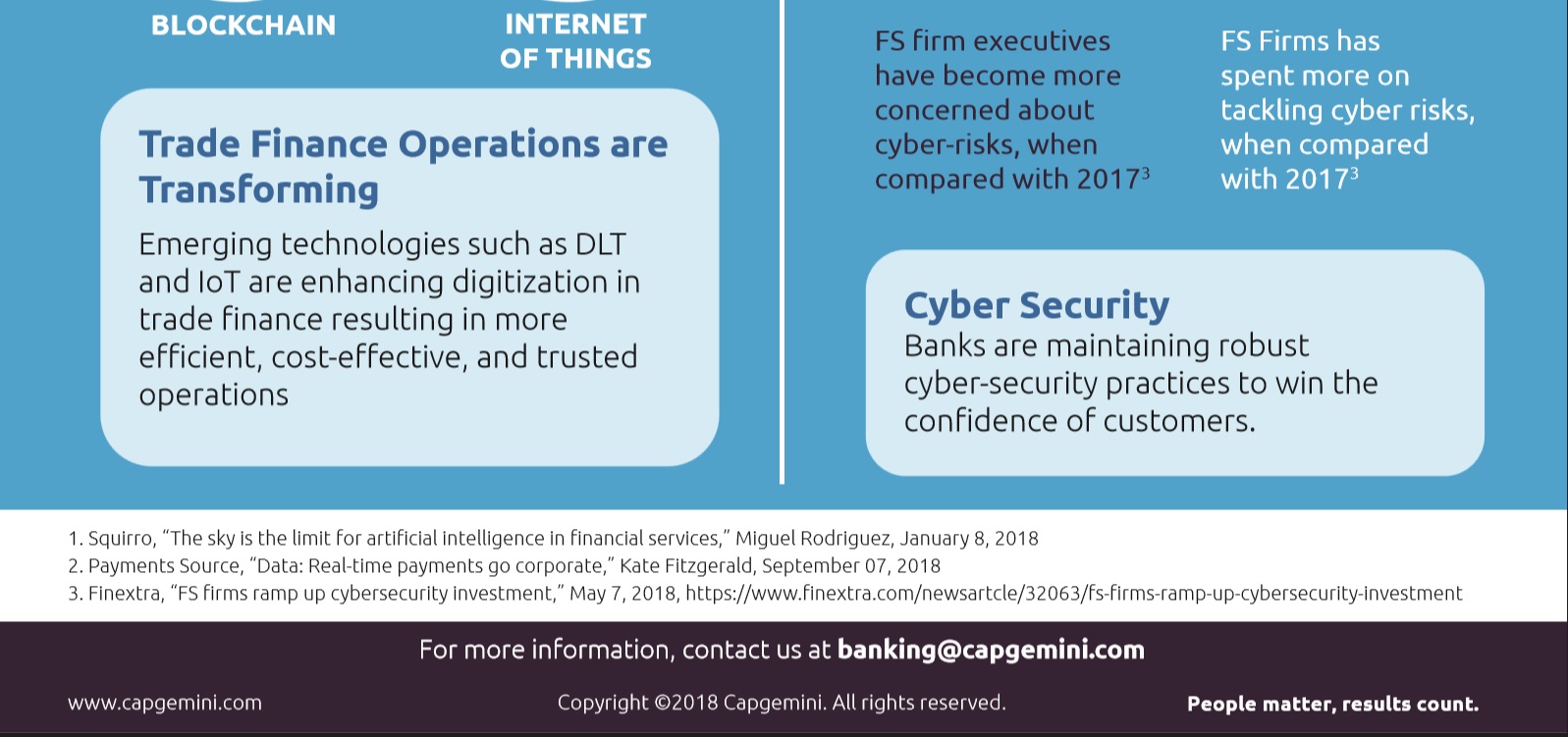

Many commercial banks have begun to integrate their systems with that of their clients to extract deep customer insights and leverage AI and machine learning capabilities to streamline processes. Inefficiencies within important value chain areas such as payments and trade finance have been prioritized for transformation, and emerging technologies such as Distributed Ledger Technology or Internet of Things are being leveraged.

The open banking API-led economy, collaboration between banks and FinTechs, and data aggregation are all fostering improvements in services. However third-party data sharing and increased digitalization have also put a focus on data security and data-driven regulatory compliance.

To remain competitive commercial banks must stay alert to industry developments. This report aims to unpack and analyze 2019’s leading trends for commercial banks.

Sources / References:

Definition - https://www.investopedia.com/terms/c/commercialbank.asp

Functions - www.economicsdiscussion.net/banks/commercial-banks-its-functions-and-types-explained/4149

https://www.capgemini.com/resources/top-10-trends-in-commercial-banking-2019

5. Financing Consumer Activities:

5. Financing Consumer Activities: 7. Help in Monetary Policy:

7. Help in Monetary Policy:

Leave a Reply