Support and resistance (S&R) levels are among the most crucial concepts in technical analysis. They provide traders with clear benchmarks for making entry and exit decisions. Understanding these levels can help you maximize profits, minimize risks, and confidently navigate the stock market.

This post covers types of support and resistance, identification techniques, trading strategies, common mistakes, and actionable examples, making it a complete guide for traders of all levels.

What Are Support and Resistance Levels?

Support and resistance are price levels where stocks tend to pause or reverse:

- Support: The price level where demand is strong enough to stop a stock from falling further. Buyers tend to step in here.

- Resistance: The price level where selling pressure is strong enough to stop the stock from rising. Sellers dominate at this level.

Example:

If a stock repeatedly falls to ₹500 but bounces back each time, ₹500 acts as support. Conversely, if it repeatedly rises to ₹600 but fails to break, ₹600 acts as resistance.

Why Support and Resistance Are Important

Support and resistance levels are valuable because they:

- Indicate high-probability entry and exit points

- Help define risk and reward levels

- Aid in trend identification and reversal detection

Scenario:

A stock approaching a strong support level can be an opportunity for a long trade, while one hitting a strong resistance may be ideal for a short trade. Combining S&R with other indicators like moving averages or RSI enhances reliability.

Types of Support and Resistance Levels

- Horizontal Support and Resistance

- These levels remain constant over time.

- Identified by previous highs and lows.

- Example: ₹500 support or ₹600 resistance.

- Trendline Support and Resistance

- Diagonal levels connecting higher lows in an uptrend or lower highs in a downtrend.

- Example: An upward sloping line connecting three swing lows over two weeks.

- Moving Average as Dynamic S&R

- EMAs or SMAs act as dynamic support or resistance.

- Example: Price bouncing off EMA 20 during an uptrend.

- Psychological Levels

- Round numbers like ₹500, ₹1000, or ₹2000 often act as key psychological support/resistance levels.

- Traders place stop-loss or take-profit orders at these levels.

How to Identify Support and Resistance

Step 1: Historical Price Analysis

- Look at previous swing highs and lows.

- Repeated bounces indicate strong S&R levels.

Step 2: Use Moving Averages

- Short-term EMAs for intraday support/resistance.

- Long-term SMAs for trend-based levels.

Step 3: Trendlines

- Draw lines connecting higher lows in uptrends or lower highs in downtrends.

Step 4: Volume Confirmation

- Higher volume near support/resistance confirms its strength.

Example:

A stock bouncing off ₹750 support with increasing volume signals a strong buy opportunity.

Trading Strategies Using Support and Resistance

1. Range Trading

- Concept: Buy near support, sell near resistance in sideways markets.

- Tip: Confirm range with volume and oscillators.

Example:

Stock X trades between ₹500–₹600 for three weeks. Enter buy orders near ₹500, sell near ₹600, and set stops slightly below support.

2. Breakout Trading

- Concept: Enter trades when price breaks strong S&R levels.

- Confirmation: Look for volume spike or candle close above/below level.

Example:

Stock Y breaks ₹600 resistance with double average volume. Enter long trade, target next resistance level.

Pro Tip: Avoid false breakouts by confirming close above/below the level on higher timeframes.

3. Pullback Trading

- Concept: Enter trades after a breakout pulls back to the previous S&R level.

- Why it works: Previous resistance often becomes new support, and vice versa.

Example:

Stock Z breaks ₹800 resistance, pulls back to ₹800, and resumes upward trend. Enter long trade at ₹800, stop-loss slightly below.

Advanced Techniques

1. Fibonacci Retracement Levels

- Identify potential support/resistance using Fibonacci percentages: 23.6%, 38.2%, 50%, 61.8%.

- Works well with trends to predict pullbacks.

Example:

Stock trending from ₹500 → ₹700 retraces 38.2% → buy near ₹623.6.

2. Pivot Points

- Widely used in intraday trading.

- Calculate central pivot and associated support/resistance levels.

- Helps traders anticipate key reversal points.

3. Candlestick Patterns

- Reversal patterns near S&R increase trade probability.

- Examples: Hammer at support, Shooting Star at resistance.

Example:

Hammer forms at ₹500 support → bullish reversal signal confirmed by volume increase.

Common Mistakes to Avoid

- Ignoring volume → weak levels may fail

- Over-reliance on a single timeframe → combine multiple timeframes

- Ignoring trend → trading counter-trend at key levels increases risk

- Poor stop-loss placement → leads to unnecessary losses

Tip: Always define risk/reward ratio and follow disciplined trading.

Example Trading Plan Using S&R

Scenario: Intraday strategy using horizontal support/resistance:

- Identify key support/resistance levels on 15-min chart.

- Monitor volume for breakout/pullback confirmation.

- Enter trades near S&R with tight stop-losses.

- Exit at next key level or trailing stop.

Outcome: Proper analysis and disciplined execution can capture 2–3% moves consistently, even with small intraday swings.

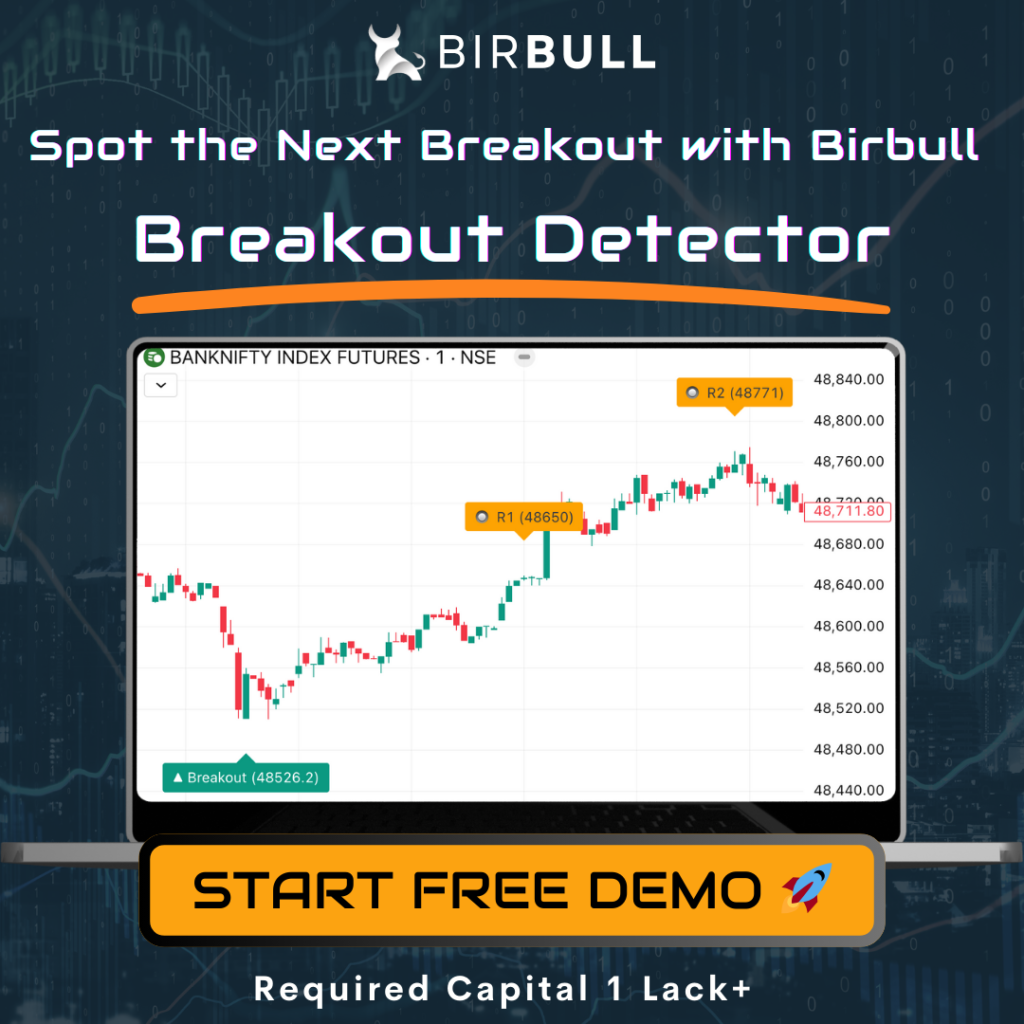

Using Technology for S&R

Platforms like Birbull Channel provide:

- Realtime alerts for S&R breaks

- Automated watchlists

- Customizable charts to highlight key levels

Automation ensures traders don’t miss opportunities and can act faster than manual analysis.

Combining S&R With Other Indicators

- Moving Averages: Confirms dynamic support/resistance

- RSI/MACD: Confirms trend strength or potential reversals

- Volume: Validates breakouts or pullbacks

Example:

Stock breaks resistance at ₹1000, RSI above 60, volume doubles → high-probability long entry.

Psychological Levels and Trader Behavior

- Traders often react at round numbers, making them self-fulfilling S&R levels.

- Example: ₹1000 in NSE stock becomes a magnet for both buyers and sellers.

Understanding market psychology improves trade timing and confidence.

Final Thoughts

Support and resistance are foundational tools in stock trading. Mastering them allows traders to:

- Enter trades with clear risk/reward

- Identify trend reversals early

- Combine with other indicators for high-probability trades

Platforms like Birbull provide ready-to-use watchlists, alerts, and analysis, but mastering these concepts gives traders independent trading strength.

Leave a Reply