Residential real estate is an area developed for people to live on. Defined by local governance laws, residential real estate cannot be used for commercial or industrial purposes. It can vary from location to location and can restrict how many buildings are allowed on a single block and what kinds of municipal services reach those buildings. Real estate is always referred to as Land plus any buildings and resources on that land.

Residential areas encompass a large variety of potential dwellings, from houses to houseboats, and from dwellings ranging from the slum to the wealthiest suburban subdivision. Many of these are not specifically real estate, which is a legal definition describing a state of ownership: residential real estate emerges when land sanctioned for residential use is purchased by someone, which becomes real property.

Residential real estate is often the most important financial investment a person owns, and the value of real property on the estate is subject to shifts in the real estate market. Some people purchase real estate in the hope of making money, either by selling it at a profit or leasing it to others and charging them rent. But most people simply live on their property.

Types of Residential Real Estate

Condominiums

A condominium is defined as the individual ownership of a building with access to common areas owned by all residents within the complex. Association fees must be paid to maintain, repair, and improve the common areas shared by residents, which typically include a pool, spa, tennis courts, walking paths, and more. Banks and lenders often finance condos at higher interest rates.

A condominium is defined as the individual ownership of a building with access to common areas owned by all residents within the complex. Association fees must be paid to maintain, repair, and improve the common areas shared by residents, which typically include a pool, spa, tennis courts, walking paths, and more. Banks and lenders often finance condos at higher interest rates.

Condotels

A “condotel” is a sort of hybrid condominium and hotel. Condotels typically have a registration desk or concierge, as well as daily cleaning services, food and telephone service, and operate as hotels despite the fact that units are owned individually. Condotels may also feature short-term occupancy, although they can serve as long-term residences as well. Note that many mortgage lenders will not finance condotels.

Investment Properties

A property that is non-owner occupied, owned for the purpose of financial gain either through renting and/or appreciation. Even if the property does not generate income, if the owner does not occupy the home, it is considered an investment property. Investment properties include single-family residences and multi-unit properties. Multi-unit investment properties are among the most expensive to finance.

Manufactured Homes

Often referred to as “mobile homes” or “trailer parks”, these types of properties are constructed on a non-removable steel chassis which allows them to be transported. These homes are often located on leased land, such as in trailer parks and adhere to the Federal Construction Safety Standards Act (HUD/CODE). They provide low-income housing as well as lifestyle housing for groups such as senior citizens. Financing may be in the form of a personal property loan, and at a premium to mortgage loans.

Often referred to as “mobile homes” or “trailer parks”, these types of properties are constructed on a non-removable steel chassis which allows them to be transported. These homes are often located on leased land, such as in trailer parks and adhere to the Federal Construction Safety Standards Act (HUD/CODE). They provide low-income housing as well as lifestyle housing for groups such as senior citizens. Financing may be in the form of a personal property loan, and at a premium to mortgage loans.

Modular Homes

Modular homes are similar to manufactured homes, though they adhere to building codes required by the specific state, county, and locality, and do not carry building or zoning regulations. They also differ from manufactured homes in that they don’t have an axle or frame, and must be transported on a flat-bed truck or like vehicle. Financing may be in the form of a personal property loan, and at a premium to mortgage loans.

Multi-Unit Properties

Multi-unit properties can be primary residences or investment properties. A 2-unit property for example may be occupied by the owner in one unit, and a tenant in the other unit, defining it as a multi-unit primary residence. Or a 4-unit property may be solely occupied by tenants, defining it as a multi-unit investment property. Multi-unit properties carry additional financing adjustments to fee, more substantial for 3-4 unit properties.

Second Homes (Vacations Homes)

Second Homes, also known as “vacation homes” are residences typically found in recreation areas or resorts that serve as seasonal accommodation. These properties are in owned in addition to a primary residence, and can be condominiums, townhouses, or single-family residences. Vacation homes are common in ski resorts and near the beach, and may be rented out to other vacationers while not in use. Financing is more expensive than single-family residences, but less than investment properties.

Single-Family Residences

This is the most standard property type which is designed to support just one dwelling. This type of property does not include a common area as you’d find in a condominium complex and similar developments. They do not share walls with neighboring properties, and should have land separation from all sides of the property, as well as above and below. These are the cheapest properties to finance, as they are the norm.

Townhouses

A single-family dwelling typically made up of two floors that shares side walls with nearly identical properties. It differs from a condominium in that no neighboring unit is above or below, and usually features an outdoor space in front and behind the property. It’s similar to a condominium in that tenants have access to a common area such as pool, spa, tennis courts and more. Many banks and lenders consider townhouses single-family residence, making mortgage financing more affordable.

Things to note when buying a physical property

Whether your intention is to buy a property for investment, retirement or providing a second home for your children studying abroad, there are a number of things to take into consideration:

Whether your intention is to buy a property for investment, retirement or providing a second home for your children studying abroad, there are a number of things to take into consideration:

- Knowledge is key. Consider underlying political, economic and demographic trends. Do your research or get an independent expert to do it for you.

- Be clear on what you want from your real estate investment. Do you want income, capital growth or a mixture of both – or do you just want a property to be kept over the long term?

- Don’t forget about running costs. Will you be paying too much to own, run and repair the property? Understand how interest rate changes may impact your mortgage repayment.

- Compare mortgage types and rates. Some mortgage types may include fixed rates and / or variable rates. Be aware of the difference between interest only and capital repayment.

- When buying an overseas property, be aware of the impact of foreign exchange rates on your purchase.

- Talk to your bank or a professional finance adviser about the best way to structure the purchase. Make sure that finance is in place before making offers. Get legal and tax advice to understand your obligations.

- Consider employing your own buying agent, valuer (appraiser) and / or negotiator (broker) to act for you if you are not a confident negotiator.

- Consider your exit strategy. Who will buy when you come to sell? How much will it cost you to exit?

- Don’t forget about insurance. Talk to your bank or an insurance adviser about the best way to protect your mortgage repayment, your legal liability and your property and household content.

- When seeking an adviser, find a company with both international coverage and a global understanding but also a strong local network and expertise. Securing these two elements will give you a great advantage.

Future Trends of Residential Real Estate

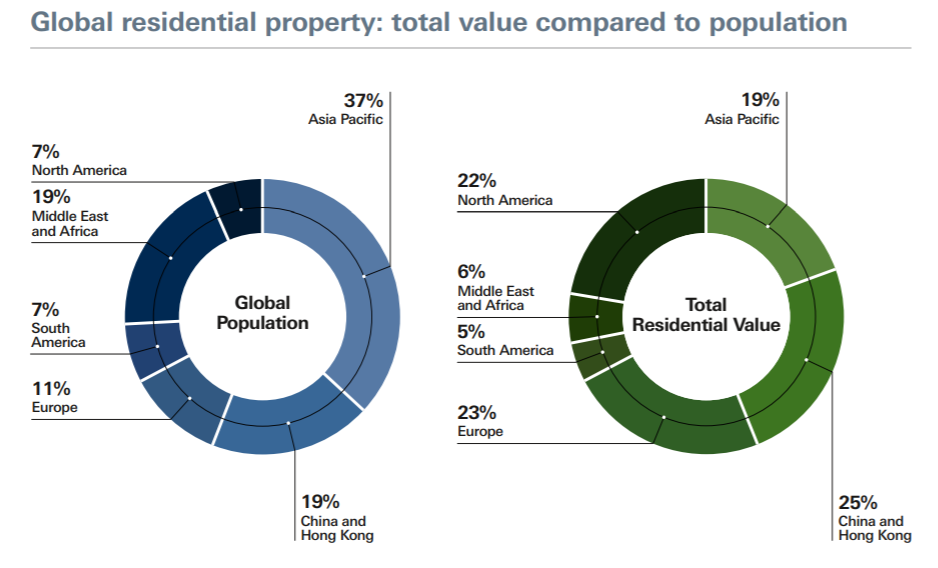

Most of the value of global real estate is in residential property. It makes up three quarters of all real estate stock and by itself totals $168.5 trillion. With around 2.05 billion households in the world, this means the average home is valued at around $82,000 but with a wide range around this figure. The highest value residential properties are concentrated in developed economies, mainly in North America and Europe.

Most of the value of global real estate is in residential property. It makes up three quarters of all real estate stock and by itself totals $168.5 trillion. With around 2.05 billion households in the world, this means the average home is valued at around $82,000 but with a wide range around this figure. The highest value residential properties are concentrated in developed economies, mainly in North America and Europe.

North America contains only 7% of the global population but 22% of all residential property assets by value. Europe tells a similar story, containing 11% of the world’s population but 23% of residential property by value. The greatest growth potential is in emerging or developing economies outside of Asia. Much of Asia has already seen real estate asset price growth as GDP per capita has grown.

Africa appears to have the greatest potential yet for value growth as national economies and household incomes increase. The Middle East & Africa region currently contains 19% of the world population, but its residential property is disproportionately worth only 6% of the global total.

Huge expansion in cities, with mixed results

- By 2050, the urban population will increase by 75% to 6.3 billion, from 3.6 billion in 2010.

- By 2025, there will be 37 ‘megacities’, up from 23 today, and 12 of these will be in emerging markets

- 1.5 million residents a month will move to Chinese cities for the rest of this decade

By 2020, the 21st century’s great migration to the cities will be well underway. Cities will be swelling across the fast-growing countries in Asia, Africa, the Middle East and Latin America. Even the developed Western nations will be urbanising, albeit at a slower pace. But not all cities will prosper. While some become great centres of wealth creation in a multipolar world, others are likely to fail.

The volume of building activity will be huge, expanding the world’s inventory of institutional-grade real estate. Global construction output is expected to almost double to US$15 trillion by 2025, up from US$8.7 trillion in 2012.5 Emerging markets in Asia will be the fastest growing region, but sub-Saharan Africa is expected to be the second highest.

Yet the philosophy of ‘build it and they will come’ won’t prove universally successful. Some cities will grow and become creative hubs, generators of economic growth. Others will destroy wealth, with poor infrastructure, slums and rampant crime. Others still will be ghost towns. In some countries, the density of main cities will drive people away, to rural environments or satellite cities.

Unprecedented shifts in population drive changes in demand for real estate

By 2050:

- The world population will be 9.3 billion, up more than 50% from 6.1 billion in 2000

- The number of people over 60 will exceed the number under 15 for the first time

- Spain will have the oldest population, Niger the youngest

Demographic shifts will affect demand for real estate fundamentally. The burgeoning middle-class urban populations in Asia, Africa and South America will need far more housing. Meanwhile, the advanced economies’ ageing populations will demand specialist types of real estate, while their requirements for family homes will moderate.

Although Africa’s population will still be growing fast in 2020, Europe’s population growth will be stalling. The middle classes are projected to grow by 180% between 2010 and 2040, with the highest proportion of middle-class people set to live in Asia rather than Europe as soon as 2015. And between 2010 and 2020, more than one billion additional middle-class consumers will emerge globally.

Cities will attract the young middle classes, especially in emerging markets. As intense competition for space increases urban density, apartments are likely to shrink. Developers will need to become more innovative about how they use space.

The global population will age at an unprecedented pace. The number of people aged 60 or older will increase by 2.8% per annum from 2025 to 2030.10 As the world ages, the cost of retirement and healthcare will become critical issues, reaching crisis proportions in some countries, as opposed to the looming concern of today. The speed of change over the next generation is alarming: the old-age dependency ratio for the world is forecast to reach 25.4% in 2050, up from 11.7% in 2010. The developing countries have the youngest populations, but they will also have the fastest pace of population ageing, giving them the least time to adapt in the years following 2020.

The advanced economies’ ageing population will limit house price rises. The Bank for International Settlements’ analysis of advanced economies estimates that the US will suffer pricing deflation averaging about 80 basis points per annum in real prices over the next 40 years, with the impact greater still in continental Europe and Japan.

Emerging markets’ growth ratchets up competition for assets

- By 2020, emerging markets will dominate the world’s top five economies

- By 2025, emerging markets will host 60% of global construction activity

- By 2025, Nigeria will need nearly 20 million new homes compared to 2012

Real estate is an integral part of the emerging markets’ growth phenomenon. In India, for example, real estate has played a large part in driving economic growth. Even as growth moderates in many emerging markets, the pace of construction activity remains rapid, increasing investment opportunities. Yet, growth is only part of the story. The rise of emerging economies is also increasing competition among real estate managers and the investment community.

Real estate is an integral part of the emerging markets’ growth phenomenon. In India, for example, real estate has played a large part in driving economic growth. Even as growth moderates in many emerging markets, the pace of construction activity remains rapid, increasing investment opportunities. Yet, growth is only part of the story. The rise of emerging economies is also increasing competition among real estate managers and the investment community.

By 2025, over 60% of all construction activity is forecast to take place in emerging markets, up from just 35% in 2005.15 Looked at another way, the following nations will account for 72% of expected construction activity: China, the US, India, Indonesia, Russia, Canada and Mexico. Emerging Asia is expected to be the fastest growing region for construction between now and 2025, followed by sub-Saharan Africa. Nigeria alone will need almost 20 million new homes compared to 2012.

The growth of emerging countries is rapidly creating powerful new real estate players and new asset managers. As a result, there is both growing competition for real estate assets and growing competition within real estate asset management.

A recent survey by Preqin showed that 54% of all sovereign wealth funds (SWFs) invest in real estate, with most SWFs from the middle East and North Africa and Asia.16 SWFs are increasingly competing for prime assets – with the survey showing that 57% of SWFs that invest in real estate have a preference for core real estate. This indicates that competition from SWFs for prime real estate in the world’s major cities, already a significant force, might well further intensify as their assets continue to grow.

As emerging markets mature, so new regional and local asset management (AM) companies with real estate arms are forming. With good connections with local developers and links with regional institutional investors, they’re in a stronger position than most Western asset managers to take advantage of growth in their home regions. By 2020, it’s likely that some of these managers will have become major global players, perhaps partly through acquiring rivals in Europe or North America (in other industries, it has become common for Chinese companies to acquire companies based in the West).

Looking out to 2020, it seems likely that intraregional real estate investment might follow existing high-growth trade routes, further increasing cross-border capital flows. Within emerging economies, for example, there are particularly strong trade flows between Asia and Latin America, and between Africa and the Middle East.

‘Sustainability’ transforms design of buildings and developments

- With a fast-growing population, by 2030 we’ll need: – 50% more energy – 40% more water – 35% more food

- By 2050, there could be 200 million environmental refugees worldwide

Cities contribute an estimated 70% of the world’s energy-related greenhouse gases while occupying just 2% of its land. Their locations – often in low-elevation coastal zones – and large populations make them particularly vulnerable to the impacts of climate change, such as rising sea levels. As the world rapidly urbanises, so the pressures to make buildings more eco-efficient are mounting.

Cities contribute an estimated 70% of the world’s energy-related greenhouse gases while occupying just 2% of its land. Their locations – often in low-elevation coastal zones – and large populations make them particularly vulnerable to the impacts of climate change, such as rising sea levels. As the world rapidly urbanises, so the pressures to make buildings more eco-efficient are mounting.

Quite how great this pressure becomes between now and 2020 depends on how sensitive the weather proves to be to climate change, and how fast energy prices rise. If extreme weather devastates a major city or destroys an annual food crop then pressure will mount, possibly with substantial new regulations. What’s more, if energy price rises continue at the current rate, pressure will increase to improve buildings’ energy efficiency, although exploitation of new energy sources could mitigate the pressure somewhat.

By 2020, it’s likely that all buildings in advanced economies will need to have sustainability ratings. What’s more, the concept of sustainability will have broadened to mean creating ‘places’ where people enjoy living and working. So, new developments will be designed with green spaces, good air quality, spaces for social gathering and so on.

Already, developers are integrating sustainability criteria into prime office buildings, new cities and individual homes. New eco-cities such as Tianjin in China and Masdar City in Abu Dhabi aim to have zero-waste and zero carbon emissions, while existing cities such as Tokyo in Japan and Malmö in Sweden simply aim for urban revitalisation. Green office buildings incorporate renewable energy technologies, waste reduction and greater use of natural light to improve economic, social and environmental performance.

For real estate asset managers, the move towards greater sustainability in building design presents opportunities and risks. While sale prices do reflect buildings’ sustainability credentials to a degree – through a ‘green premium’ – this is currently limited to certain types of prime real estate in advanced economies. If the pressure to increase buildings’ eco-efficiency mounts faster than the market currently anticipates, then many buildings could suffer a large ‘brown discount’.

Technology disrupts real estate economics

- 49% of all UK sales of electrical goods will be online by 2018

- In 2017, the global social network audience will total 2.55 billion, up more than 70% from 1.47 billion in 2012

Technology is finally coming to real estate. By 2020, it will have both altered the economics of entire subsectors of the industry, and changed the way that real estate developers and the investment community operate.

Technology is finally coming to real estate. By 2020, it will have both altered the economics of entire subsectors of the industry, and changed the way that real estate developers and the investment community operate.

Most strikingly, the need for physical space is already shrinking across most real estate subsectors. Entire retail chains are disappearing from the high streets of Western countries in sectors such as video, as their customers move online. Meanwhile, as online shopping delivery times become shorter, so the need for warehousing close to customers is growing.

In retail, we believe that stores will always have a role to play, although in sectors such as books, music and video the majority of goods will be bought online. Sectors such as health and beauty, and home-ware are likely to prove more resilient. The secret will be to combine physical and online retail on a single operating platform. For example, shopping centres that mix shopping with restaurants, entertainment and social life are likely to remain appealing.

Meanwhile, the requirement for office space is also likely to diminish. Telecommuting is just in its infancy and is likely to grow substantially in the next few years. As office culture becomes more accepting of videoconferencing rather than meetings, and as digital files replace paper, so people may spend more time working from satellite offices and home.

We think these trends are likely to alter real estate economics more than is currently anticipated. Beyond 2020, the generation that has grown up in the digital world will dominate consumer spending and the culture of work. Social networks will help to determine where and how people will want to live, work and recreate. At the same time, shrinking technological barriers will make online shopping still more appealing, perhaps through drone delivery. And telecommuting will become more practical – for example as you can easily access database applications through tablet computers.

Real estate capital takes financial centre stage

- The global stock of institutional-grade real estate will expand by more than 55% from 2012 to 2020

- Asset management assets to rise almost 60% to US$101.7 trillion by 2020

- Alternative asset allocation expected to grow 30% by 2020

Private capital will play a critical role in funding the growing and changing need for real estate and its supporting infrastructure. Just as asset managers, real estate funds and Sovereign Wealth Funds find the assets under their control swell, so governments will have increasing needs for capital to finance urbanisation. Private real estate capital will become an important partner of governments.

Private capital will play a critical role in funding the growing and changing need for real estate and its supporting infrastructure. Just as asset managers, real estate funds and Sovereign Wealth Funds find the assets under their control swell, so governments will have increasing needs for capital to finance urbanisation. Private real estate capital will become an important partner of governments.

PwC estimates that the broad AM sector will see assets under management (AuM) swell to US$101.7 trillion by 2020, up from US$63.9 trillion today. The global growth in AuM will come from three different sources: the shift towards individual retirement plans, the surge in high-net-worth individuals (HNWI) in emerging markets and growth in SWF assets. PwC anticipates that, across the entire AM sector, retirement assets will grow from US$33.9 trillion in 2012 to US$56.5 trillion in 2020; the HNWI sector will expand from US$52.4 trillion to US$76.9 trillion; the SWF sector from US$5.2 trillion to US$8.9 trillion.

This compares with our calculation that the stock of institutional investment grade real estate will expand by more than 55% from US$29.0 trillion in 2012, to US$45.3 trillion in 2020, according to our calculations. It may then grow further to US$69.0 trillion in 2030.

Leave a Reply