Venture Capital Basics

Venture capital is the term used towards investment. Its a form of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks and other financial institutions. However, it does not always take a monetary form; it can also be provided in the form of technical or managerial expertise. Venture capital is typically allocated to small companies with growth potential, or to companies that have grown quickly and appear poised to continue to expand.

. A venture capitalist places money in a company that is high risk and has a high growth. The investment is usually for a period of five to seven years. The investor will expect a return on his money either by the sale of the company or by offering to sell shares in the company to the public.

Types of Venture Capital Funding

The first professional investor to a deal at the start-up stage is referred to as the Series A investor. This investment is followed by middle and later stage funding – the Series B, C, and D rounds. The final rounds include mezzanine, late stage and pre-IPO funding. A Venture Capitalist may specialize in provide just one of these series of funding, or may offer funding for all stages of the business life cycle. It’s important to know the preferences of the Venture Capitalist you’re approaching, and to clearly articulate what type of funding you’re seeking:

- Seed Capital – If you’re just starting out and have no product or organized company yet, you would be seeking seed capital. Few VCs fund at this stage and the amount invested would probably be small. Investment capital may be used to create a sample product, fund market research, or cover administrative set-up costs.

- Startup Capital – At this stage, your company would have a sample product available with at least one principal working full-time. Funding at this stage is also rare. It tends to cover recruitment of other key management, additional market research, and finalizing of the product or service for introduction to the marketplace.

- Early Stage Capital – Two to three years into your venture, you’ve gotten your company off the ground, a management team is in place, and sales are increasing. At this stage, VC funding could help you increase sales to the break-even point, improve your productivity, or increase your company’s efficiency.

- Expansion Capital – Your company is well established, and now you are looking to a VC to help take your business to the next level of growth. Funding at this stage may help you enter new markets or increase your marketing efforts. You should seek out VCs that specialize in later stage investing.

- Late Stage Capital – At this stage, your company has achieved impressive sales and revenue and you have a second level of management in place. You may be looking for funds to increase capacity, ramp up marketing, or increase working capital.

- Bridge Financing – You may also be looking for a partner to help you find a merger or acquisition opportunity, or attract public financing through a stock offering. There are VCs that focus on this end of the business spectrum, specializing in initial public offerings (IPOs), buyouts, or recapitalization. If you are planning an IPO, a VC may also assist with mezzanine or bridge financing – short-term financing that allows you to pay for the costs associated with going public.

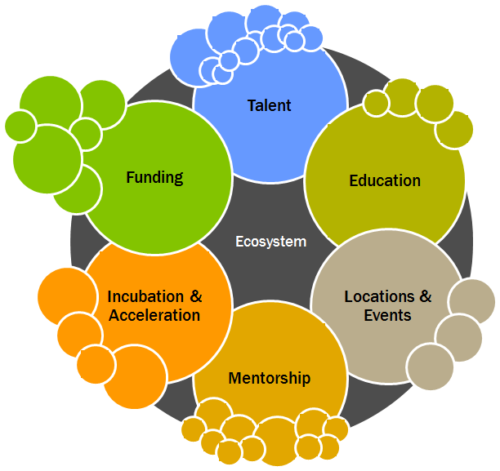

Understanding the Venture Capital Ecosystem

A Venture Capital ecosystem serves the purpose of bridging the financial gap for companies. Venture capitalists are long-term investors, who take a very active role in their portfolio companies, but are also open to short term opportunities for realizing returns on their investments. When a venture capitalist makes an investment he/she may expect to realize returns on the portfolio investments over a period of 7-10 years, on average. The initial investment may just be the beginning of a long relationship between the venture capitalist and entrepreneur. Venture capitalists provide great value by providing capital and management expertise. Venture capitalists often are invaluable in building strong management teams, managing rapid growth and facilitating strategic partnerships. Should there be opportunities for liquidating the investments due to market conditions and the performance of the portfolio company, a venture capitalist will seek to do so, sometimes well within the first few years of making the investment.

A Venture Capital ecosystem serves the purpose of bridging the financial gap for companies. Venture capitalists are long-term investors, who take a very active role in their portfolio companies, but are also open to short term opportunities for realizing returns on their investments. When a venture capitalist makes an investment he/she may expect to realize returns on the portfolio investments over a period of 7-10 years, on average. The initial investment may just be the beginning of a long relationship between the venture capitalist and entrepreneur. Venture capitalists provide great value by providing capital and management expertise. Venture capitalists often are invaluable in building strong management teams, managing rapid growth and facilitating strategic partnerships. Should there be opportunities for liquidating the investments due to market conditions and the performance of the portfolio company, a venture capitalist will seek to do so, sometimes well within the first few years of making the investment.

Risk vs. Return

A key factor for the VC will be risk versus return. The earlier a VC invests, the greater are the inherent risks and the longer is the time period until the VC’s exit. It follows that the VC will expect a higher return for investing at this early stage, typically a 10 times multiple return in four to seven years. A later stage VC may be seeking a two to four times multiple return within two years. They support the company they may invest in, from the early stages, all the way to IPO — especially those with larger funds that have billions of dollars under management.

Financial Analysts - The most junior people want to be analysts. These people are either MBA students in an internship or people that just graduated from school. The main role of analysts is to go to conferences and to scout deals that might be within the investment strategy of the fund that the VC firm is investing out of. Analysts are not able to make decisions, but they could be a good way to get your foot in the door and to have them introduce you to someone more senior within the firm. However, analysts are for the most part conducting research of the market and studying you and your competitors, so be careful with educating them too much.

Financial Analysts - The most junior people want to be analysts. These people are either MBA students in an internship or people that just graduated from school. The main role of analysts is to go to conferences and to scout deals that might be within the investment strategy of the fund that the VC firm is investing out of. Analysts are not able to make decisions, but they could be a good way to get your foot in the door and to have them introduce you to someone more senior within the firm. However, analysts are for the most part conducting research of the market and studying you and your competitors, so be careful with educating them too much.

Associate - The most immediate position after the analyst is the associate. An associate could be either junior or senior. Associates tend to be people that come with a financial background and with powerful skills in building relationships. Associates do not make decisions in a firm but they can definitely warm up an introduction with individuals involved in the decision-making.

Principal Consultants - Over associates, you will be able to find principals. They are senior people that can make decisions when it comes down to investments but they do not have full power in the execution of the overall strategy of the firm. A principal can get you inside the door and be your lead to help bring you through the entire process of receiving funding. Principals are those individuals that are close to making partner. They have power within the firm but cannot be considered the most senior within the firm.

General Partners / Managing Partners - The most senior people within a VC firm are above principals, and are called partners. Partners could be general partners or managing partners. The difference in the title varies depending on whether the individual just has the voice in investment decisions or may also have a say in operational decisions. In addition to investments, partners are also accountable for raising capital for the funds that the firm will be investing with.

Venture Partners - Lastly, venture partners are not involved in the day-to-day operations or investment decisions of the firm. Venture partners have a strategic role with the firm, mainly involving bringing new deal flow that they refer to other partners of the firm. Venture partners tend to be compensated via carry interest, which is a percentage of the returns that funds make once they cash out of investment opportunities.

Entrepreneur in Residence (EIR) - Another figure in a VC firm is the entrepreneur in residence (EIR). EIRs are mainly individuals that have a good relationship with the VC and perhaps have given the VC an exit, helping them earn cash. EIRs generally work for a year or so with the firm helping them to analyze deals that come in the door. Ultimately the goal of an EIR is to launch another start-up for positive investment.

Limited Partners - Investors of VC firms are called Limited Partners (LPs). LPs are the institutional or individual investors that have invested capital in the funds of the VC firm that they are investing off of. LPs include endowments, corporate pension funds, sovereign wealth funds, wealthy families, and funds of funds.

Securing Funds from a Venture Capitalist / Investors

First and foremost, identify the VC that might be investing within your vertical. There are plenty of tools you can use to identify who might be a fit. (You can use Crunchbase, Mattermark, CB Insights, or Venture Deal.)

Once you have your list of targets, you will need to see who you have in common and close to you who would be in a position to make an introduction. The best introductions come from entrepreneurs that have given good returns to the VC. VCs use these introductions as social proof and the stamp of approval on the relationship. The better the introduction is, the more chances you have of getting funded.

Once you have your list of targets, you will need to see who you have in common and close to you who would be in a position to make an introduction. The best introductions come from entrepreneurs that have given good returns to the VC. VCs use these introductions as social proof and the stamp of approval on the relationship. The better the introduction is, the more chances you have of getting funded.- As a next step to receiving the introduction, and in the event there is a genuine show of interest from the VC, you will have a call. Ideally you would want to go straight to the partner to save time, or the goal would be to get an introduction to the partner ASAP. If you are already in communication with the partner after the first call, he or she will ask you to send a presentation (also known as pitch deck) if the call goes well and there is interest.

- After the partner has reviewed the presentation, she will get back to you (or perhaps her assistant) in order to coordinate a time for you to go to the office and to meet face to face. During this meeting, you’ll want to connect on a personal level and to see if you have things in common. The partner will ask questions. If you are able to address every concern well and the partner is satisfied then you will be invited to present to the other partners.

- The partners meeting is the last step to getting to the term sheet. All the decision-making partners will be in the same room with you. Ideally the partner you have been in communication with has spoken highly of you, unless there have been issues (which you’ve hopefully covered by this time).

- You’ll receive a term sheet if you were able to satisfy the concerns put forward at the partners meeting. Remember that term sheet is just a promise to give you financing. It does not mean that you will get the capital. It is a non-binding agreement. If you want to dig deeper into term sheets.

- Following the term sheet, the due diligence process begins. It will typically take a VC one to three months to complete the due diligence. Unless there are no major red flags you should be good to go, and receive the funds in the bank once all the offering documents have been signed and executed.

How Venture Capitalists Monetize

VCs make money on management fees and on carried interest. Management fees are generally a percentage of the amount of capital that they have under management. Management fees for the VC are typically around 2%. The other side of making money is the carried interest. To understand this concept, carried interest is basically a percentage of the profits. This is normally anywhere between 20% and 25%. It is normally in the largest range if the VC is a top tier firm such as Accel, Sequoia, or Kleiner Perkins.

In order to cash out and receive the carried interest, the VC needs to have the portfolio of each one of the funds making an exit, which means that the company is acquired or will through an IPO where investors are able to sell their position. Normally exits take between five to seven years if the company has not run out of money or the founders have run out of energy. Typically VCs want to sell their position within eight to 10 years, especially if they are early stage investors.

Start-ups are a very risky type of asset class and nine out of 10 will end up failing. For that reason, VCs will go for those companies with the potential of giving them a 10x type of return so that it can help them with the losses of other companies inside their portfolios. If you are not able to project these kinds of returns, a VC might not be the route to follow for financing.

How Venture Capitalist Involve with Companies

VCs would like to have a clear involvement with your company in order to stay close to their investment and to have a say in major decisions that could impact their returns in the long run.

With this in mind, VCs will normally buy in equity between 15% to 45% of your company. Normally in earlier stage rounds, it tends to be on the higher end but VCs need to be mindful of the stake they leave with the entrepreneur so that they are still motivated enough to stick around and to continue focusing on the execution.

With this in mind, VCs will normally buy in equity between 15% to 45% of your company. Normally in earlier stage rounds, it tends to be on the higher end but VCs need to be mindful of the stake they leave with the entrepreneur so that they are still motivated enough to stick around and to continue focusing on the execution.

VCs will request board involvement in return for the investment that they are making in your company. There are two types of board levels. One will be the board of director seat in which they participate in major decisions of the company. This is especially important when it comes to future rounds of financing or merger and acquisition transactions (also called M&A).

The other level of board involvement is what is known as board observer, which means they will have an open invitation to attend meetings without a vote. In my experience they still have a lot of influence. Below is an image comparing directors vs. observers.

Understanding the Value

Most VC's say the main reason why an entrepreneur should consider working with a VC is because of the value they can bring to the overall strategy and execution of the business. However, that is an overstatement. An entrepreneur need to exercise caution and do their due diligence to choose right partner.

Efforts should be to really understand if a VC is going to add value in addition to capital. This value can be introductions for potential partnerships, their network of other successful founders, or the infrastructure the firm brings. The infrastructure could be the most attractive part. VCs like Andreessen Horowitz or First Round Capital have a dedicated team of marketers, recruiters and other resources to bring into a company they invest in. Ultimately this helps in fueling the growth of the business.

Choosing a Venture Capital Partner

As a founder you want to ask the right questions, which will help you understand if the VC is truly interested in investing, or what style of partners you will be onboarding to your company after the financing round is closed. If the VC firm has not invested in more than 6 months in new companies, that indicates that the VC is having trouble closing their next fund or that they are in fundraising mode. If this is the case, move on to the next VC, otherwise the process will be put on hold. Closing a fund typically can take between 12 to 24 months. You always want to choose to work quickly.

As a founder you want to ask the right questions, which will help you understand if the VC is truly interested in investing, or what style of partners you will be onboarding to your company after the financing round is closed. If the VC firm has not invested in more than 6 months in new companies, that indicates that the VC is having trouble closing their next fund or that they are in fundraising mode. If this is the case, move on to the next VC, otherwise the process will be put on hold. Closing a fund typically can take between 12 to 24 months. You always want to choose to work quickly.

Ask how they typically work with portfolio companies. Ask the VC to make an introduction to a few founders from companies that have gone out of business. These questions can provide a complete picture and see how they behave when they are on the other side of the mountain. During the dating phase everyone is happy without any worries so don‘t be mistaken as people change when there is money on the line.

In addition, ask about allocations to the options pool for employees of companies your size. (This should be written out in the deal’s terms.) If you see they want to allocate over 20% on a seed round, or over 10% on a Series A, round of financing that could mean they may eventually want to replace the founding team.

The deal flow funnel of a VC is typically what you will find represented on the image below. On average, out of 1,000 companies a partner ends up investing in 3 to 4 of them on a yearly basis. This means that only 0.2% companies receive VC financing.

Differences between Venture Capital and Private Equity

There is confusion between these two types of investors. Venture capital firms tend to work throughout the life cycles of a company, all the way to the liquidity event, when the start-up either gets acquired or goes through an IPO.

VCs are also very much involved in the operational structure. However, the main difference is that VCs invest in people with a greater degree of risk than a traditional private equity (PE) firm. PEs will go more for the numbers. They invest in businesses that are already formed, where the outcome is more predictable.

PEs will often invest in growth stages and later rounds, so your start-up, if you are in the early stage, will most likely not be a fit. Wait until you are at a Series C or Series D round of financing before seeking funding from private equity.

Future Trends of Venture Capital - 2020 to 2025

Zebras

“Zebra” is a term created to contrast the unicorn, which has typically referred to companies valued at $1 billion or more. Zebras represent companies that are profitable, sustainable, and beneficial to society. As I’ve been digging into this trend, I can see the need to insert a new metaphor in the startup world.

Unicorns are being chased at all costs, and it’s had a negative effect on entrepreneurs. What may start as an idealistic passion to change the world can easily get bastardized into chasing user acquisition, monthly recurring revenue (MRR), and hockey stick growth…at any cost.

And that’s what is really behind the Zebra trend: a reality check that every startup doesn’t need to be a unicorn. VC proves this with a long list of companies they fund, and other companies that have scaled based on revenue rather than funding (also note how simple their own website is: the zebra mentality is carried through top to bottom).

It’s not that becoming a unicorn is inherently bad, but the mentality to get there can create a series of bad decisions that lead to failed products like the Juicero—a SaaS-based juice startup—when simply making a better juicer would’ve been sufficient.

Venture capital firms are investing heavily in software

Software impacts many industries, including the entertainment and music industries; one of his examples was the rise of Spotify. This trend will continue as VC's invest in software in the years to come. “Look at what happened with Netflix and streaming, and how that’s impacting traditional channels. We’re now starting to see it in financial services. We’re seeing it in health care delivery and we may see it education over time.

Companies are staying private for a longer period of time

Historically, companies would go public about five to six years after they were founded. However, this pattern has changed in recent decades. “The trend we see today, is a long-term structural change, is companies staying private for 10 or 12 years,” From an investment perspective, venture capital firms will follow companies for longer amounts of time after early-stage investing to capture more appreciation, an approach that will benefit both investors and the firms.

Liquid secondary market for private company shares

There may be more opportunities for investors to buy and exchange equity before a company goes public. For example, the stock exchange NASDAQ recently bought the Private Exchange Group, which allows someone who owns shares of a private company to sell the equity to someone else before an IPO. We’re going to have some kind of hybrid public-private market and over a five to 10-year period, more people (will be able to) transact in pre-public companies in a way that I think actually is beneficial to this primary goal of improving compensation.

Better access to venture capital

The funding environment for venture capital is not very geographically diverse: Most venture capital firms are grouped along the coasts. He said that markets need to continue to build more diverse pipelines to reach more talent and broaden financial opportunities. “In general, the spoils of venture capital have not been well distributed geographically,” he said. “I actually think if we’re sitting here 10 or 20 years from now — I would be shocked if we don’t see better democratization of access to capital.”

A Focus On Value And ValuesInvestors to think more like operators rather than passive check writers, more investors to realize that they’re service providers, and it’s their job to help their portfolio companies succeed. They’re not there just to pick winners. They should be mentoring the entire executive team and providing hands-on operational expertise to help them become winners.

Second, more focus on values. We’ve seen loud and clear what happens when companies are instructed to grow at all costs. Company executives and their investors need to think through the potential negative social impacts of their decisions. This includes not just the first-order impacts, but longer-term, unintended consequences as well. We spent lot of time thinking about the future of work, and social concerns come into play loud and clear as we consider how social inequality could be widened by automation and AI."

Embracing Diversity Of Every KindThe new unicorns of 2019 look different from their predecessors. They’re different types of companies created by different kinds of founders, based in different locations. An increasing number of highly valued companies are based outside the usual tech hubs like the San Francisco Bay Area, and an increasing number are founded by women and under-represented groups.

"Diverse venture teams, much like all business teams, outperform non-diverse teams. Yet, the majority of VCs are white males with similar educational, professional and socioeconomic backgrounds. Such homogeneity in backgrounds can lead to homogeneity in thinking; worse yet, it’s often flawed. While groups like All Raise and Diversity VC are improving the status quo, it’s not happening fast enough. Far too few VCs come from diverse or disadvantaged backgrounds, and still, only nine percent of venture partners are women. Founders deserve partners who understand and can empathize with their unique perspectives across all dimensions – gender and ethnic, national and socioeconomic backgrounds, as well as points of view, skillsets, and professional and personal experiences. Founders who partner with firms whose leaders come from diverse backgrounds and work collaboratively (rather than as silos, as some firms do) benefit from a portfolio of diverse thought and expertise that can help startups avoid pitfalls and identify and seize strategic opportunities.

Leave a Reply