An Investment Bank (IB) is a financial intermediary that performs a variety of services. Most Investment banks specialize in large and complex financial transactions, such as underwriting, acting as an intermediary between a securities issuer and the investing public, facilitating mergers and other corporate reorganizations and acting as a broker or financial adviser for institutional clients.

The advisory division of an investment bank (IB) is paid a fee for their services, while the trading division experiences profit or loss based on its market performance. Professionals who work for investment banks may have careers as financial advisors, traders or salespeople. An investment banking career can be very lucrative, but it typically comes with long hours and significant stress.

Investment banks are most known for their work as financial intermediaries. That is, they help corporations issue new shares of stock in an initial public offering (IPO) or follow-on offering. They also help corporations obtain debt financing by finding investors for corporate bonds. The investment bank’s role begins with pre-underwriting counseling and continues after the distribution of securities in the form of advice. The investment bank will also examine the company’s financial statements for accuracy and publish a prospectus that explains the offering to investors before the securities are made available for purchase.

- Investment banks specialize in complex financial transactions, such as underwriting, IPOs, facilitating mergers and other corporate reorganizations and acting as a broker or financial advisor.

- Size is an asset for investment banks, where the more connections the bank has the more likely it is to profit.

- Because investment banks have external clients, but also trade their own accounts, a conflict of interest can occur.

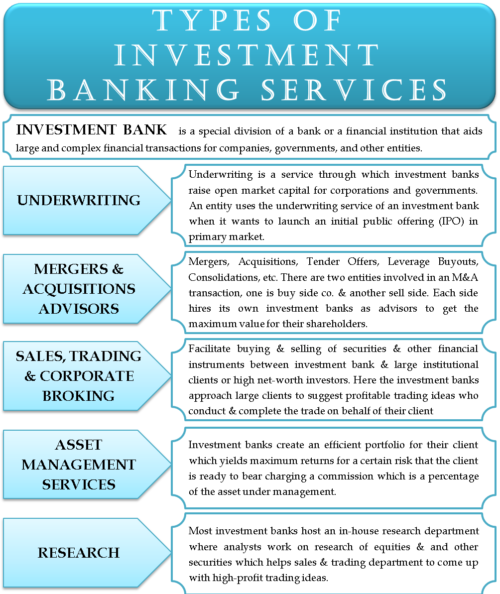

Types of Investment Bank Activities

Financial Advisors

Financial Advisors

As a financial advisor to large institutional investors, the job of an investment bank is to act as a trusted partner that delivers strategic advice on a variety of financial matters. They accomplish this mission by combining a thorough understanding of their clients' objectives, industry and global markets with strategic vision trained to spot and evaluate short- and long-term opportunities and challenges facing their client.

Mergers and Acquisitions

Handling mergers and acquisitions is a key element of an investment bank's work. The main contribution of an investment bank in a merger or acquisition is evaluating the worth of a possible acquisition and helping parties arrive at a fair price. An investment bank also assists in structuring and facilitating the acquisition in order to make the deal go as smoothly as possible.

Research

The research divisions of investment banks review companies and author reports about their prospects, often with "buy", "hold" or "sell" ratings. While research may not generate revenue itself, the resulting knowledge is used to assist traders and sales. Investment bankers, meanwhile, receive publicity for their clients. Research also provides investment advice to outside clients in the hopes that these clients will take their advice and complete a trade through the trading desk of the bank, which would generate revenue for the bank. Research maintains an investment bank's institutional knowledge on credit research, fixed income research, macroeconomic research, and quantitative analysis, all of which are used internally and externally to advise clients.

UnderwritingA more traditional role for Investment Bankers has been to assist corporations and governments raising capital, which falls in the purview of the underwriting department. Bankers in this department specialize either in debt or equity and might also specialize by industry. These bankers need to be able to liaison with their clients in order to determine their capital needs while also working closely with traders and security sales personnel in order to determine the market situation and the price that any security may command in the market. As with most other investment bank jobs, underwriters might end up spending extra hours, when working on a deal.

Private Equityprivate equity jobs are currently the hottest and most prestigious positions in all of finance. The massive compensation and the bonuses on the senior members of the firm contribute to this craze. While these jobs can be found within an investment bank, there are many prestigious venture capital firms such as Black-stone, KKR and TPG, to get into which one would need to have excellent track record in investment banking or if you’re a fresher you need to have more than excellent academic record and it helps if you’re from a top tier university.

Venture Capital

While Private Equity firms invest in established companies, Venture Capital firms specialize in investments in New or Startup companies in various industries that are particularly fast moving and growing (eg: Bio-technology, green technology, ecommerce etc.,). While many of these companies fail, the payoffs from few winners outweighs the losses from many failures. The single most skill that people working in Venture Capital must possess is the ability to identify the right opportunities at the right time. Many wish to get into venture capital for this thrill that the jobs have to offer. The compensation as with other investment banking jobs is handsome and the work hours are just as long.

Size is an asset in the investment banking business, where bigger banks have a greater opportunity to profit by matching buyers and sellers.

Future of Investment Banking

Investment banks were at the top of the finance world. With torrential growth and return on investment (ROI) driven largely by the trading of complex financial instruments, Lehman Brothers, Bear Stearns, Goldman Sachs and others achieved record profits and awarded unprecedented bonuses.

After the collapse of Lehman and Bear Stearns and the global financial crisis that ensued, the business models of the world’s biggest investment banks needed to change.

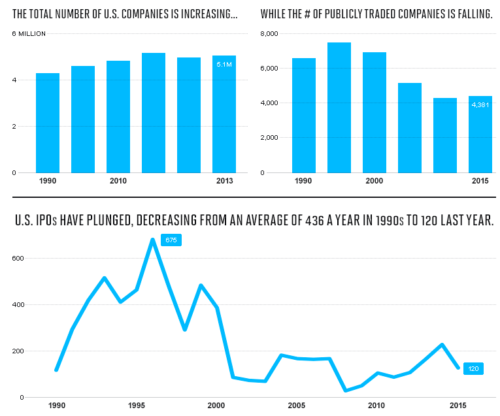

The Disruption of the IPO

Underwriting an initial public offering (IPO) is a highly profitable business for an investment bank.

Underwriting an initial public offering (IPO) is a highly profitable business for an investment bank.

A company decides it wants to raise money by going public, and an investment bank helps by connecting them with willing investors, promoting the company’s stock, navigating complex legal frameworks, helping determine a price for the stock, and purchasing an agreed-upon number of shares and reselling them, thus taking on risk for how the stock will perform. For this work, the underwriting bank can make tens of millions from an IPO — whether or not the stock performs well.

But today, the powerful tech companies fueling the world’s biggest IPOs are exerting their influence, using their size and name recognition to extract lower fees from the investment banks. Some are also exploring alternatives to the IPO, like the direct public offering (DPO) and alternative exchanges, and even in some limited cases, initial coin offerings (ICO). And perhaps the trend that’s had the biggest impact — some big companies are electing not to go public at all.

Thanks in part to an abundance of cash being offered by venture capitalists and sovereign wealth funds, many startups are opting to stay private indefinitely. As a result, investment banks are having to chase more deals and reaping lower revenues for doing so.

In 2017, investment banks generated $7.3B in revenue from underwriting IPOs: a 43% reduction since 2000, adjusted for inflation. IPOs once accounted for around 25% of investment bank revenues, but in recent years that figure has decreased to about 15%, according to Seeking Alpha.

Major investment banks still have a big impact on IPOs. Of 2018’s 7 best performing tech IPOs, according to Motley Fool, 6 used either Goldman Sachs or Morgan Stanley, or both, as underwriters. Facebook, eBay, General Motors, Twitter, and Dropbox are just a few examples of major IPOs that were underwritten by one or both of these firms in years past.

In return for all of this, investment banks charge an underwriting fee that traditionally comes in at around 3-7% of the gross proceeds of the IPO. The exact size of the fee depends on the type of deal. Standard, sub-$500M raises and more complex IPOs are more likely to result in a fee around 7%, while larger or simpler IPOs may end up closer to 3%.

Taking a hefty fee mitigates the investment bank’s risk by insulating it from the stock’s actual performance in the market.

When Facebook went public in 2012, the stock fell 15% in its first few days on the market. Despite this, the Wall Street Journal reported that Morgan Stanley, Goldman Sachs, and the company’s other underwriters made $175M in fees.

Some have even accused investment banks of mispricing stocks, alleging that the banks deliberately underprice new stocks in order to engineer a “pop” on their first day of trading — benefiting the bank but also the institutional investors that the bank brought into the stock.

STAYING PRIVATE

Today, the biggest threat to investment banks’ IPO function may be the trend towards not going public at all.

IPO activity has dropped from its recent height in 2013. There were nearly 6x asmany $100M+ private financing rounds as IPOs of US venture-backed technology firms in 2018. For the companies that did go public, it was later than it has been in recent years — a median time of 10 years from inception to IPO, compared to a median time-to-IPO of less than 7 years in 2013.

IPO activity has dropped from its recent height in 2013. There were nearly 6x asmany $100M+ private financing rounds as IPOs of US venture-backed technology firms in 2018. For the companies that did go public, it was later than it has been in recent years — a median time of 10 years from inception to IPO, compared to a median time-to-IPO of less than 7 years in 2013.

Flush with cash, more startups than ever before are choosing to forgo the public market and stay private for far longer than in years past.

While staying private has its disadvantages, the approach does offer startups far less scrutiny from regulators and freedom from the pressure on quarterly results that public companies are subject to. This is a significant factor for startups that need a long runway before they can show consistent growth and profitability. For their investors, staying private can give companies more time to grow into their valuation.

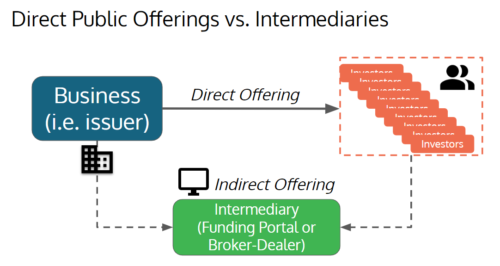

DIRECT PUBLIC OFFERINGS

With all the name recognition many tech companies have already earned themselves, some startups have decided that they can just list themselves on the stock market directly.

In April 2018, Spotify did just that and demonstrated how the emergence of tech as a major driver of the economy’s returns could one day reshape the way all companies go public. Instead of an IPO, Spotify filed for a direct public offering, or DPO — they began selling shares directly to the investing public without going through the underwriting process.

In April 2018, Spotify did just that and demonstrated how the emergence of tech as a major driver of the economy’s returns could one day reshape the way all companies go public. Instead of an IPO, Spotify filed for a direct public offering, or DPO — they began selling shares directly to the investing public without going through the underwriting process.

Spotify’s DPO was seen as largely a success. On its first day of trading, Spotify’s stock price experienced a volatility of 12.3% — lower than most other large-scale tech IPOs — indicating an underlying confidence in the company. Over the months that followed, Spotify’s stock price increased by around 30% to reach a high of $192, though it has since decreased to levels more on par with its initial pricing. However, the company was able to achieve its primary goal for going public in the first place: providing liquidity to its shareholders.

The DPO model is intriguing to private companies because it could save them much of the sizable fee they might otherwise pay to an investment bank. While Spotify still worked with a few investment banks to help organize the logistics behind the unconventional deal, those advisors made a small fraction of what they would have on an IPO — only reaching about $30M amongst the three banks, according to The Wall Street Journal. Spotify’s choice to go public without an underwriter diminished the value of the banks’ special relationships with institutional investors.

Even if DPOs don’t become common for typical companies looking to go public, they will still likely remain an attractive option for large tech companies. The most successful startups today have better access to late stage capital and also tend to have high levels of social capital. Before Slack, for example, it would be hard to imagine an enterprise chat app becoming a household name, but today, Slack is a well-known brand. When companies plotting to go public already have the prestige that comes with growth and success, along with strong consumer sentiment, it becomes much harder to convince them of the added value from hiring an investment bank to help them go public.

ALTERNATIVE EXCHANGES

Other technology companies are looking to cut the cost of going public and simplify the listing process by creating alternative exchanges. This includes the Investor’s Exchange (IEX) and the Long Term Stock Exchange (LTSE), which take aim at market data and exchange access fees charged by major exchanges like Nasdaq and the New York Stock Exchange (NYSE).

IEX received approval as a registered stock exchange in 2017 and is now looking to attract trading volume away from exchanges by letting companies list for free. In October 2018, IEX listed its first public company, Interactive Brokers. IEX will let companies list for free for the first five years, before charging a flat annual rate of $50,000.

Today, IEX has a market share of 2.5% of trading volume, compared to incumbent exchanges like the Nasdaq and the New York Stock Exchange which have about 20% each. Though small, IEX’s position relative to the market has been steadily on the rise and the 5-year free listing period could be attractive for companies looking for alternative ways to go public.

INITIAL COIN OFFERINGS

Though its long-term future as a fundraising technique is highly uncertain and its application so far has been raising money for very early-stage companies, the idea of selling shares in a company directly to consumers using the blockchain offers a kind of alternative to the public stock market.

Though its long-term future as a fundraising technique is highly uncertain and its application so far has been raising money for very early-stage companies, the idea of selling shares in a company directly to consumers using the blockchain offers a kind of alternative to the public stock market.

In an initial coin offering (ICO), instead of going public on an exchange or raising equity financing, companies instead issue their own cryptocurrency, avoiding the need for bankers at all. Most companies don’t give any equity away in their ICOs either — instead, giving their investors a cryptographic token that could potentially rise in value.

In 2017, startups raised $5.6B from ICOs worldwide, and the growth continued into the early months of 2018. However, interest in ICOs has cooled after a number of fraud allegations and a crackdown by the SEC, with only $118M raised in Q1’19, according to TokenData — that said, experimentation in the field is likely to continue, whether through emerging technologies or other innovations. While ICOs are unlikely to have a huge impact on the IPO market anytime soon, they are a signal of the many ways private companies are coming up with new ways to avoid the expensive IPO process.

The disruption of M&A

Mergers & acquisitions (M&A) is a traditionally relationship-driven industry built on big transactions and big fees. For investment banks, M&A has historically been one of the most reliable revenue streams. Today, however, the power in M&A is starting to be distributed more evenly. M&A activity accounted for about 34% of investment bank revenue in 2018, according to Dealogic — down from 44% in 2015, according to Ansarada.

At the same time, fees going to specialized boutique banks like Qatalyst have been increasing, rivaling even the biggest banks like Goldman Sachs.

At the same time, fees going to specialized boutique banks like Qatalyst have been increasing, rivaling even the biggest banks like Goldman Sachs.

The last few years have also seen a significant uptick in the number of private M&As undertaken without the assistance of an investment bank. In 2015, according to Dealogic, 26% of M&A deals worth $1B+ took place without outside financial advisors, a 13% increase from the year before.

Technology is changing the nature of dealmaking and proving that much of the M&A value chain can be commodified. In the middle market (deals worth between $10M to $1B in value), private, online networks and SaaS tools are giving smaller company executives and brokers the ability to conduct M&A transactions on their own more quickly and far more affordably.

M&A-AS-A-SERVICE

The capabilities of new technologies built to help both companies and banks complete mergers & acquisitions are part of why companies big and small are increasingly taking the leap into “DIY” M&A.

Axial Networks, which Bloomberg called “the Tinder for M&A,” is a platform to connect startups with potential buyers. The company said in 2018 that it had facilitated $25B worth of deals since its launch in 2010.

Axial Networks, which Bloomberg called “the Tinder for M&A,” is a platform to connect startups with potential buyers. The company said in 2018 that it had facilitated $25B worth of deals since its launch in 2010.

Brokers and executives who want to join Axial pay a subscription fee that starts in the low thousands. Users input their company financials into the tool, and it helps match them up with buyers or lenders on the platform.

- Because it’s not limited by the network of one bank, there’s a greater pool of potential buyers.

- It’s much less expensive. On a $10M acquisition, a 3% fee paid out to an investment bank will amount to $300,000. Axial cost between $15,000 and $90,000 a year in 2015 but prices, since then, have reportedly fallen.

BOUTIQUE BANKS

Since the financial crisis, the large investment bank has become the source of some suspicion when it comes to handling large scale M&A. Since banks like Goldman advise on M&A deals andtrade, some executives view them with distrust. Smaller banks that don’t trade may be seen to have fewer potential conflicts of interest when it comes to their advisory work.

In June of 2017, Qatalyst Partners and Centerview Partners — two of the most elite boutique investment banks in the world — finished just behind Goldman Sachs, Morgan Stanley, and JP Morgan in the Financial Times’ 2017 fee rankings. This demonstrates how boutique banks have become “more powerful and profitable than previously recognized.”

In June of 2017, Qatalyst Partners and Centerview Partners — two of the most elite boutique investment banks in the world — finished just behind Goldman Sachs, Morgan Stanley, and JP Morgan in the Financial Times’ 2017 fee rankings. This demonstrates how boutique banks have become “more powerful and profitable than previously recognized.”

Qatalyst, which focuses on technology, handled the sales of OpenTable (to Priceline) and LinkedIn (to Microsoft), while Centerview Partners, which focuses more on consumer products and pharma, handled the sales of Kraft Foods (to Heinz) and Lorillard (to Reynolds American). Qatalyst, in particular, became famous for generating higher-than-average premiums for its specific type of client — and of course, as a result, the firm likely is able to further attract some of the most high-profile clients, creating a self-reinforcing cycle. In 2011, Qatalyst’s clients received approximately 70% average premiums on their deals compared to where shares were trading 4 weeks prior to deal, according to Thomson Reuters. By comparison, the typical tech firm at the time sold for approximately 37% higher premiums.

CHANGING MOTIVATIONS

The “traditional M&A” was often driven by a desire to boost EPS (earnings per share), with companies seeking to combine assets with a similar business, merging with a business in a lower-tax jurisdiction, or looking to gain desirable assets owned by other businesses.

Investment banks were ideal partners for these kinds of deals, which fueled the merger mania on Wall Street in the 1980s, because they had spent decades executing M&A from the perspective of increasing earnings per share (EPS), understanding the impacts of a deal on a company’s balance sheet, and identifying synergies, such as expanded production capacities or creating economies of scale. Today, executives are more focused on strategic M&A, rather than a quick EPS fix. While strategic M&A isn’t new, tech companies today are especially focused on building more competitive long-term businesses by buying into new product spaces and expanding their portfolios.

The disruption of asset management

Asset management for institutions, high net worth individuals and other private clients is one of the most profitable financial services today.

Since the financial crisis, however, new regulations making it harder for investment banks to trade with client money and new types of financial products have made dedicated asset managers the most popular place for investors broadly to put their money. Today, most asset management revenue goes to BlackRock, Vanguard, Fidelity, and State Street. Notably, these firms are not burdened by the same kinds of regulations as investment banks.

Asset management for institutions, high net worth individuals and other private clients is one of the most profitable financial services today.

Since the financial crisis, however, new regulations making it harder for investment banks to trade with client money and new types of financial products have made dedicated asset managers the most popular place for investors broadly to put their money. Today, most asset management revenue goes to BlackRock, Vanguard, Fidelity, and State Street. Notably, these firms are not burdened by the same kinds of regulations as investment banks.

The biggest asset manager today, BlackRock, began its ascent when it bought iShares, Barclays’ exchange-traded fund (ETF) platform. ETFs are investment funds that consist of different securities, usually pegged to some index — giving potential investors the ability to easily diversify their investments. Because trading with ETFs is passive, they involve lower costs — in the case of iShares, about one-tenth that of an equivalent mutual fund.

The disruption of Equities research

Equity research — reports on companies, securities, and markets for investment banking clients — is an industry that has been in decline for the last decade. But more recently, the European Commission’s Markets in Financial Instruments Directive II (MiFID II), which went into effect in 2018, has nearly made this traditional function of the big investment banks obsolete.

MiFID II banned the “bundling” of research with trade execution, compelling investment banks to price and sell their research as a separate product. This triggered a re-evaluation of the value of that research among the clients of the world’s investment banks, with many deciding that they could go without. In addition, new technologies like natural language processing, which helps computers to analyze human communication, are offering more efficient means to automate the writing of research reports. While some of these technologies have actually been developed or white-labeled by incumbents, they are also being deployed by smaller companies eyeing another opportunity to further cut into investment banks’ historic functions.

While sell-side analysts still offer corporate access on behalf of buy-side investors, such as hedge funds, the research side of the job has been fundamentally disrupted. The result has been layoffs among equity research staff at investment banks around the world and cutbacks in the level of investment in research. At the same time, smaller, independent research firms with the capability to specialize have found their fortunes on the rise, while buy-side shops such as dedicated mutual funds, pension funds, and hedge funds, have been building up their own internal research capabilities.

The disruption of Sales & Trading

Perhaps nowhere has the combination of post-financial crisis regulations and technological disruption had more effect on investment banks than in their sales & trading departments. Today, banks only make money from trading by charging their clients a commission on each executed trade. Before the financial crisis, however, investment banks could execute on their own trading strategies using their own money and keep the profits. In 2009, JP Morgan, Citigroup, Bank of America, Goldman Sachs, and Morgan Stanley made almost $100B from trading alone.

But a massive sea change for the banks began with the Volcker Rule, which came into effect in 2014 and was passed as part of Dodd-Frank, which banned investment banks from prop trading, or making bets with their own capital. The thesis behind the Volcker Rule was that when banks were empowered to use leverage in trading and make riskier bets, it increased the chances of those trades going poorly and putting the whole bank, along with client’s money, at risk.

Coinciding with the Volcker Rule’s passage, various financial regulators around the world increased capital requirements, forcing investment banks to keep a higher ratio of their capital on hand rather than in trades. A few years into the Volcker ruling, however, the investment banking divisions of the world’s biggest banks were suddenly less profitable than retail and other divisions.

Disruptive Technologies

Investment banking is one of the most disrupted industries among all. It is comprised of private partnerships focused on specific markets and financial products. The industry was considered as traditional but has to reinvent new models to thrive in new technology-driven markets. Artificial intelligence, big data, interactive platforms, virtual reality and many such upcoming innovations in digital markets are fast altering the way business is conducted including investment banking. In financial markets, digital platforms for trading are common today which indicates at the urgent need for reforms in investment banking systems and the consolidation of multiple trading platforms.

Changing the Business Method

Companies who are major clients of the investment bankers no longer see the value of raising capital in the public markets. These companies often find it a better option to stay private because of the high regulatory and reporting costs, other sources of capital, and lower technology costs. The total number of companies publicly listed has decreased over the past decade. Since last few decades’ average numbers of companies going public have gradually reduced from annual three hundred to just one hundred at present. Few of the large companies have found ways to raise money outside of the traditional investment banking methods to grow with their models. Investment banking is no longer a must-have intermediate service for their business methods. Each company has its own culture and processes carried out by its staff. It has its own market and clients base. Everyone has their own way to solve the problems but companies must tackle the emergencies and adverse situations faster. Option to wait and see is no longer a choice.

Transforming Investment Banks

There are several challenges like tougher regulatory requirements for capital, low leverage, liquidity and collateral have substantially lower bank ROEs, complex, higher margin products. Commoditization of banking with increasing price transparency, risk management, and business controls have made banking structures costly. Outdated technology is inflexible and expensive to maintain hence it is no longer viable. The short-term tactical changes and improvements may give a temporary solution but a complete transformation will be required in the banks for success in the future.

Client-Centric Approach

The coordination between the teams of client service units with other functional departments will be required to enhance across product groups. Banks need to prioritize among clients for the service, and the banker staff behavior needs to get more professionally optimized at the organizational level. Investment banks will have to invest in products to present a comprehensive experience to the client. Client-centric service models that combine content, transactions and services will be successful.

Leave a Reply