Venture Capital is the term used towards investment. Funding for startups is plentiful in the current economy where New record amounts of investment are being made, and by a diverse range of investors. Knowing who these active investors are may help shorten the time it takes to get funded, while providing more efficiency in the process.

“Do your homework, learn who your ideal investors are, and design a powerful pitch deck that gets their attention, and closes the deal faster”

Below Article reveals data on who are the active VCs are now, and who might be the best investors to pitch with your deck. There is plenty of money out there, from plenty of hungry investors. The most dollars are going into late stage startups, followed by early stage funding, then funding for technology growth and angel or seed series rounds.

Now find out who is handing out the cash.

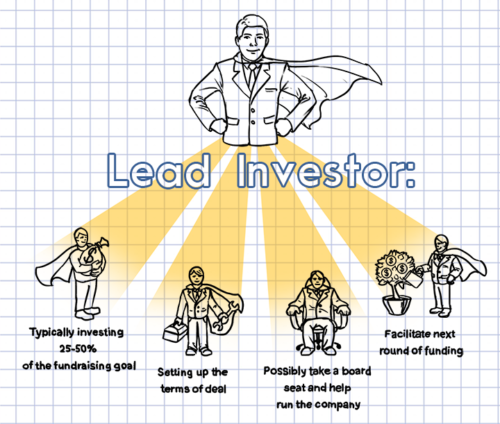

TOP LEAD INVESTORS

Whenever you are pitching, you want to be sure you are reaching those who are most likely to fund your type of round. Tthese were the most active investors in seed rounds during the past 3 months.

| S.No | Name of the Venture Capital | Official Website |

| 1 | Start-Up Chile | https://www.startupchile.org/ |

| 2 | Insight Venture Partners | https://www.insightpartners.com/ |

| 3 | Tencent Holdings | https://www.tencent.com/en-us/about.html |

| 4 | New Enterprise Associates | https://www.nea.com/about |

| 5 | Sequoia Capital China | https://www.sequoiacap.com/china/en/ |

| 6 | Accel | https://www.accel.com/ |

| 7 | Sequoia Capital | https://www.sequoiacap.com/companies/ |

| 8 | Higher Ground Labs | https://highergroundlabs.com/ |

| 9 | Quake Capital Partners | https://www.quakecapital.com/ |

| 10 | Goldman Sachs | https://www.goldmansachs.com/ |

MOST ACTIVE SEED STAGE INVESTORS

Whenever you are pitching, you want to be sure you are reaching those who are most likely to fund your type of round. These were the most active investors in seed rounds during the past 3 months.

Whenever you are pitching, you want to be sure you are reaching those who are most likely to fund your type of round. These were the most active investors in seed rounds during the past 3 months.

| S.No | Name of the Venture Capital | Official Website |

| 1 | Start-Up Chile | https://www.startupchile.org/ |

| 2 | Hiventures | https://www.hiventures.hu/en/home |

| 3 | Crowdcube | https://www.crowdcube.com/ |

| 4 | Plug and Play | https://www.plugandplaytechcenter.com/ |

| 5 | Innovation Works | https://www.innovationworks.org/ |

| 6 | 500 Startups | https://500.co/ |

| 7 | Innova Memphis | https://www.innovamemphis.com/ |

| 8 | Entrepreneurs Roundtable | https://www.eranyc.com/ |

| 9 | Berkeley SkyDeck Fund | https://skydeck.berkeley.edu/ |

| 10 | Quake Capital Partners | https://www.quakecapital.com/ |

Top Early Stage Investors – If you are raising an early stage round, consider these active players:

| S.No | Name of the Venture Capital | Official Website |

| 1 | IDG Capital | https://www.idgcapital.com/ |

| 2 | New Enterprise Associates | https://www.nea.com/about |

| 3 | Sequoia Capital China | https://www.sequoiacap.com/china/en/ |

| 4 | Accel | https://www.accel.com/ |

| 5 | Y Combinator | https://www.ycombinator.com/ |

| 6 | ZhenFund | http://en.zhenfund.com/ |

| 7 | Sequoia Capital | https://www.sequoiacap.com/companies/ |

| 8 | Matrix Partners China | https://www.matrixpartners.com.cn/index.php/en/about-us/about-us |

| 9 | Intel Capital | https://www.intel.com/content/www/us/en/intel-capital/overview.html |

| 10 | Index Ventures | https://www.indexventures.com/ |

Most Active Late Stage Investors – If you are looking to raise a Series B or anything above for a growth stage round you may want to tap into the following firms:

| S.No | Name of the Venture Capital | Official Website |

| 1 | Sequoia Capital | https://www.sequoiacap.com/companies/ |

| 2 | Tencent Holdings | https://www.tencent.com/en-us/about.html |

| 3 | Insight Venture Partners | https://www.insightpartners.com/ |

| 4 | Bpifrance | https://www.bpifrance.com/ |

| 5 | Goldman Sachs | https://www.goldmansachs.com/ |

| 6 | Bessemer Venture Partners | https://www.bvp.com/ |

| 7 | New Enterprise Associates | https://www.nea.com/about |

| 8 | Khosla Ventures | https://www.khoslaventures.com/ |

| 9 | Andreessen Horowitz | https://a16z.com/ |

| 10 | Sequoia Capital China | https://www.sequoiacap.com/china/en/ |

PITCH - Factors to Consider Choosing the Right Venture Capitalist

When strategizing who you will pitch, it is not only worth looking at who has recently been active in putting money into deals, but who is achieving successful exits, and may now be flush with capital and bullish on reinvesting some of those gains. Connecting with potential investors, presenting and attending meetings takes up precious time that could be used to work on and push your business forward. Getting funded can help to make big leaps in growth, but it is still a task that should be approached efficiently. As an entrepreneur, your biggest resource is time.

The data above may reveal the willingness of different venture capital firms to get involved at different series of funding, and at different positions within each of those fundraising rounds. Data on exits and fundraising by these firms can also be useful for gauging who has the liquidity and sense of urgency to act quickly in the months ahead as well.It is smart to know which potential angel and venture capital firm investors are most likely to place capital into your industry. Have they shown interest in your type of business, product category, or size of deal you are offering? Have they been successful in it? Was it a good experience for them? Could your venture help compliment other recent investments they’ve made?

Knowing if they are likely to stay in the game and follow up with more capital in your next fundraising round can be valuable too. That could dramatically reduce the time and effort you have to make next time.

Perhaps even more importantly, are they a good fit for you? Remember that money is just one reason to venture down this path. It’s only one of the benefits of these relationships. Ask yourself how they can help beyond the money. What is their history of relationships with the startups and CEOs they’ve funded in the past? Is there alignment in goals, values, timelines and the terms they likely to offer?

Leave a Reply